Hsa Eligibility And Contribution Worksheet

ADVERTISEMENT

HSA Eligibility and

Contribution Worksheet

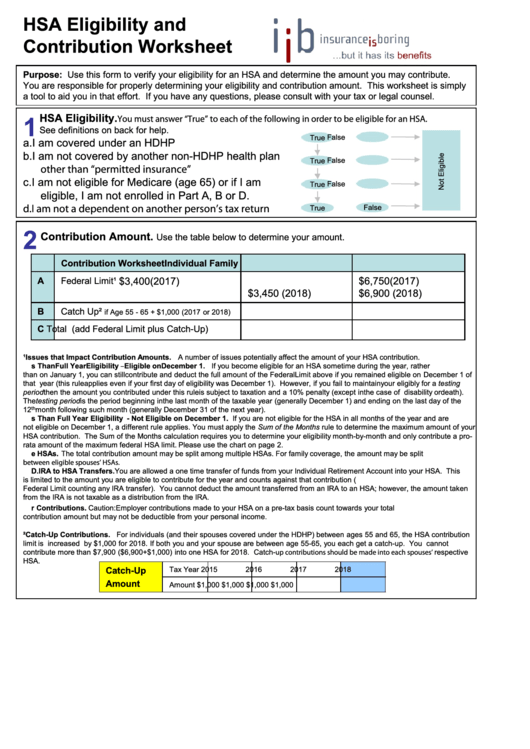

Purpose: Use this form to verify your eligibility for an HSA and determine the amount you may contribute.

You are responsible for properly determining your eligibility and contribution amount. This worksheet is simply

a tool to aid you in that effort. If you have any questions, please consult with your tax or legal counsel.

1

HSA Eligibility.

You must answer “True” to each of the following in order to be eligible for an HSA.

See definitions on back for help.

False

True

a. I am covered under an HDHP

b. I am not covered by another non-HDHP health plan

False

True

other than “permitted insurance”

c. I am not eligible for Medicare (age 65) or if I am

False

True

eligible, I am not enrolled in Part A, B or D.

d. I am not a dependent on another person’s tax return

False

True

2

Contribution Amount.

Use the table below to determine your amount.

Contribution Worksheet

Individual

Family

A

Federal Limit¹

$3,400 (2017)

$6,750

(2017)

$3,450 (2018)

$6,900 (2018)

B

Catch Up²

if Age 55 - 65 + $1,000 (2017 or 2018)

C

Total (add Federal Limit plus Catch-Up)

¹Issues that Impact Contribution Amounts. A number of issues potentially affect the amount of your HSA contribution.

A. Less Than Full Year Eligibility – Eligible on December 1. If you become eligible for an HSA sometime during the year, rather

than on January 1, you can still contribute and deduct the full amount of the Federal Limit above if you remained eligible on December 1 of

that year (this rule applies even if your first day of eligibility was December 1). However, if you fail to maintain your eligibly for a testing

period then the amount you contributed under this rule is subject to taxation and a 10% penalty (except in the case of disability or death).

The testing period is the period beginning in the last month of the taxable year (generally December 1) and ending on the last day of the

12

th

month following such month (generally December 31 of the next year).

B. Less Than Full Year Eligibility - Not Eligible on December 1. If you are not eligible for the HSA in all months of the year and are

not eligible on December 1, a different rule applies. You must apply the Sum of the Months rule to determine the maximum amount of your

HSA contribution. The Sum of the Months calculation requires you to determine your eligibility month-by-month and only contribute a pro-

rata amount of the maximum federal HSA limit. Please use the chart on page 2.

C. Multiple HSAs. The total contribution amount may be split among multiple HSAs. For family coverage, the amount may be split

between eligible spouses’ HSAs.

D. IRA to HSA Transfers. You are allowed a one time transfer of funds from your Individual Retirement Account into your HSA. This

is limited to the amount you are eligible to contribute for the year and counts against that contribution (i.e. you cannot put in more than the

Federal Limit counting any IRA transfer). You cannot deduct the amount transferred from an IRA to an HSA; however, the amount taken

from the IRA is not taxable as a distribution from the IRA.

E. Employer Contributions. Caution: Employer contributions made to your HSA on a pre-tax basis count towards your total

contribution amount but may not be deductible from your personal income.

²Catch-Up Contributions. For individuals (and their spouses covered under the HDHP) between ages 55 and 65, the HSA contribution

limit is increased by $1,000 for 2018. If both you and your spouse are between age 55-65, you each get a catch-up. You cannot

contribute more than $7,900 ($6,900+$1,000) into one HSA for 2018. Catch-up contributions should be made into each spouses’ respective

HSA.

Catch-Up

Tax Year

2015

2016

2017

2018

Amount

Amount

$1,000

$1,000

$1,000

$1,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2