DR 0104AMT (08/21/13)

*130104AM19999*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

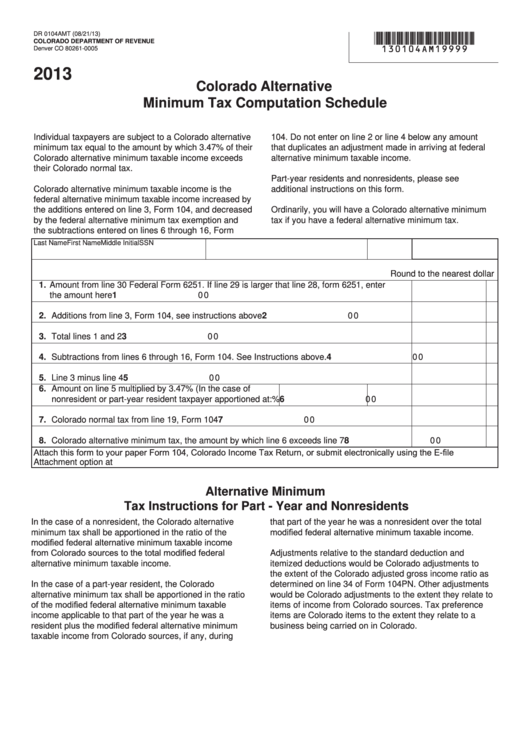

2013

Colorado Alternative

Minimum Tax Computation Schedule

Individual taxpayers are subject to a Colorado alternative

104. Do not enter on line 2 or line 4 below any amount

minimum tax equal to the amount by which 3.47% of their

that duplicates an adjustment made in arriving at federal

Colorado alternative minimum taxable income exceeds

alternative minimum taxable income.

their Colorado normal tax.

Part-year residents and nonresidents, please see

Colorado alternative minimum taxable income is the

additional instructions on this form.

federal alternative minimum taxable income increased by

the additions entered on line 3, Form 104, and decreased

Ordinarily, you will have a Colorado alternative minimum

by the federal alternative minimum tax exemption and

tax if you have a federal alternative minimum tax.

the subtractions entered on lines 6 through 16, Form

Last Name

First Name

Middle Initial SSN

Round to the nearest dollar

1. Amount from line 30 Federal Form 6251. If line 29 is larger that line 28, form 6251, enter

the amount here

1

0 0

2. Additions from line 3, Form 104, see instructions above

2

0 0

3. Total lines 1 and 2

3

0 0

4. Subtractions from lines 6 through 16, Form 104. See Instructions above.

4

0 0

5. Line 3 minus line 4

5

0 0

6. Amount on line 5 multiplied by 3.47% (In the case of

nonresident or part-year resident taxpayer apportioned at:

%

6

0 0

7. Colorado normal tax from line 19, Form 104

7

0 0

8. Colorado alternative minimum tax, the amount by which line 6 exceeds line 7

8

0 0

Attach this form to your paper Form 104, Colorado Income Tax Return, or submit electronically using the E-file

Attachment option at

Alternative Minimum

Tax Instructions for Part - Year and Nonresidents

In the case of a nonresident, the Colorado alternative

that part of the year he was a nonresident over the total

modified federal alternative minimum taxable income.

minimum tax shall be apportioned in the ratio of the

modified federal alternative minimum taxable income

from Colorado sources to the total modified federal

Adjustments relative to the standard deduction and

alternative minimum taxable income.

itemized deductions would be Colorado adjustments to

the extent of the Colorado adjusted gross income ratio as

In the case of a part-year resident, the Colorado

determined on line 34 of Form 104PN. Other adjustments

alternative minimum tax shall be apportioned in the ratio

would be Colorado adjustments to the extent they relate to

of the modified federal alternative minimum taxable

items of income from Colorado sources. Tax preference

income applicable to that part of the year he was a

items are Colorado items to the extent they relate to a

resident plus the modified federal alternative minimum

business being carried on in Colorado.

taxable income from Colorado sources, if any, during

1

1 2

2