Instructions For Arizona Form 300 - Nonrefundable Corporate Tax Credits And Recapture - 2014

ADVERTISEMENT

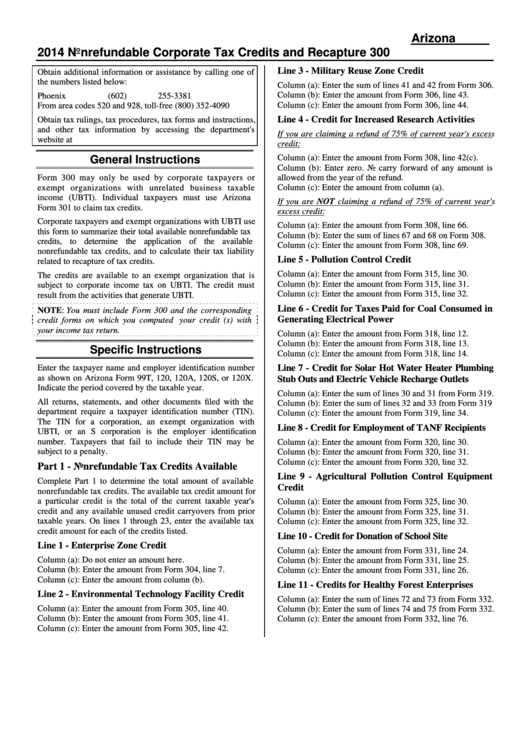

Arizona Form

2014 Nonrefundable Corporate Tax Credits and Recapture

300

Line 3 - Military Reuse Zone Credit

Obtain additional information or assistance by calling one of

the numbers listed below:

Column (a): Enter the sum of lines 41 and 42 from Form 306.

Column (b): Enter the amount from Form 306, line 43.

Phoenix

(602) 255-3381

Column (c): Enter the amount from Form 306, line 44.

From area codes 520 and 928, toll-free

(800) 352-4090

Line 4 - Credit for Increased Research Activities

Obtain tax rulings, tax procedures, tax forms and instructions,

and other tax information by accessing the department's

If you are claiming a refund of 75% of current year's excess

website at

credit:

Column (a): Enter the amount from Form 308, line 42(c).

General Instructions

Column (b): Enter zero. No carry forward of any amount is

Form 300 may only be used by corporate taxpayers or

allowed from the year of the refund.

Column (c): Enter the amount from column (a).

exempt organizations with unrelated business taxable

income (UBTI). Individual taxpayers must use Arizona

If you are NOT claiming a refund of 75% of current year's

Form 301 to claim tax credits.

excess credit:

Corporate taxpayers and exempt organizations with UBTI use

Column (a): Enter the amount from Form 308, line 66.

this form to summarize their total available nonrefundable tax

Column (b): Enter the sum of lines 67 and 68 on Form 308.

credits, to determine the application of the available

Column (c): Enter the amount from Form 308, line 69.

nonrefundable tax credits, and to calculate their tax liability

Line 5 - Pollution Control Credit

related to recapture of tax credits.

Column (a): Enter the amount from Form 315, line 30.

The credits are available to an exempt organization that is

Column (b): Enter the amount from Form 315, line 31.

subject to corporate income tax on UBTI. The credit must

Column (c): Enter the amount from Form 315, line 32.

result from the activities that generate UBTI.

Line 6 - Credit for Taxes Paid for Coal Consumed in

NOTE: You must include Form 300 and the corresponding

Generating Electrical Power

credit forms on which you computed your credit (s) with

your income tax return.

Column (a): Enter the amount from Form 318, line 12.

Column (b): Enter the amount from Form 318, line 13.

Specific Instructions

Column (c): Enter the amount from Form 318, line 14.

Enter the taxpayer name and employer identification number

Line 7 - Credit for Solar Hot Water Heater Plumbing

as shown on Arizona Form 99T, 120, 120A, 120S, or 120X.

Stub Outs and Electric Vehicle Recharge Outlets

Indicate the period covered by the taxable year.

Column (a): Enter the sum of lines 30 and 31 from Form 319.

All returns, statements, and other documents filed with the

Column (b): Enter the sum of lines 32 and 33 from Form 319

department require a taxpayer identification number (TIN).

Column (c): Enter the amount from Form 319, line 34.

The TIN for a corporation, an exempt organization with

Line 8 - Credit for Employment of TANF Recipients

UBTI, or an S corporation is the employer identification

number. Taxpayers that fail to include their TIN may be

Column (a): Enter the amount from Form 320, line 30.

subject to a penalty.

Column (b): Enter the amount from Form 320, line 31.

Column (c): Enter the amount from Form 320, line 32.

Part 1 - Nonrefundable Tax Credits Available

Line 9 - Agricultural Pollution Control Equipment

Complete Part 1 to determine the total amount of available

Credit

nonrefundable tax credits. The available tax credit amount for

a particular credit is the total of the current taxable year's

Column (a): Enter the amount from Form 325, line 30.

credit and any available unused credit carryovers from prior

Column (b): Enter the amount from Form 325, line 31.

taxable years. On lines 1 through 23, enter the available tax

Column (c): Enter the amount from Form 325, line 32.

credit amount for each of the credits listed.

Line 10 - Credit for Donation of School Site

Line 1 - Enterprise Zone Credit

Column (a): Enter the amount from Form 331, line 24.

Column (a): Do not enter an amount here.

Column (b): Enter the amount from Form 331, line 25.

Column (b): Enter the amount from Form 304, line 7.

Column (c): Enter the amount from Form 331, line 26.

Column (c): Enter the amount from column (b).

Line 11 - Credits for Healthy Forest Enterprises

Line 2 - Environmental Technology Facility Credit

Column (a): Enter the sum of lines 72 and 73 from Form 332.

Column (a): Enter the amount from Form 305, line 40.

Column (b): Enter the sum of lines 74 and 75 from Form 332.

Column (b): Enter the amount from Form 305, line 41.

Column (c): Enter the amount from Form 332, line 76.

Column (c): Enter the amount from Form 305, line 42.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4