Form 49r - Recapture Of Idaho Investment Tax Credit

ADVERTISEMENT

F

49R

RECAPTURE OF IDAHO INVESTMENT TAX CREDIT

O

R

M

EFO00033

07-14-15

Name(s) as shown on return

Social Security number or EIN

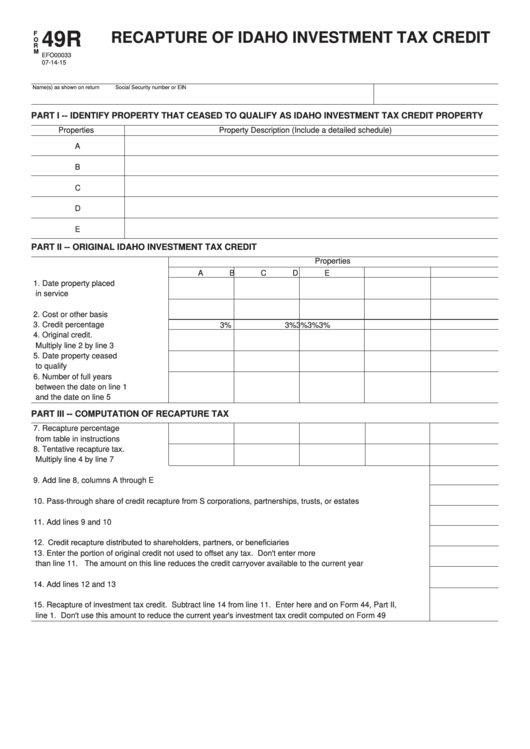

PART I -- IDENTIFY PROPERTY THAT CEASED TO QUALIFY AS IDAHO INVESTMENT TAX CREDIT PROPERTY

Properties

Property Description (Include a detailed schedule)

A

B

C

D

E

PART II -- ORIGINAL IDAHO INVESTMENT TAX CREDIT

Properties

A

B

C

D

E

1. Date property placed

in service .....................................

2. Cost or other basis ......................

3. Credit percentage .......................

3%

3%

3%

3%

3%

4. Original credit.

Multiply line 2 by line 3 ................

5. Date property ceased

to qualify ......................................

6. Number of full years

between the date on line 1

and the date on line 5 .................

PART III -- COMPUTATION OF RECAPTURE TAX

7. Recapture percentage

from table in instructions .............

8. Tentative recapture tax.

Multiply line 4 by line 7 ................

9. Add line 8, columns A through E ..........................................................................................................................

10. Pass-through share of credit recapture from S corporations, partnerships, trusts, or estates .............................

11. Add lines 9 and 10 ...............................................................................................................................................

12. Credit recapture distributed to shareholders, partners, or beneficiaries ..............................................................

13. Enter the portion of original credit not used to offset any tax. Don't enter more

than line 11. The amount on this line reduces the credit carryover available to the current year ......................

14. Add lines 12 and 13 .............................................................................................................................................

15. Recapture of investment tax credit. Subtract line 14 from line 11. Enter here and on Form 44, Part II,

line 1. Don't use this amount to reduce the current year's investment tax credit computed on Form 49 ............

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2