Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Schedule

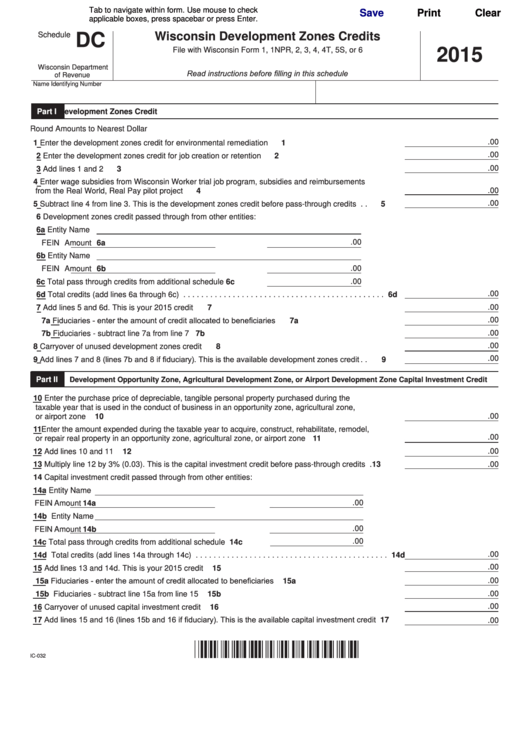

Wisconsin Development Zones Credits

DC

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

2015

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

Part I

Development Zones Credit

Round Amounts to Nearest Dollar

.00

1

Enter the development zones credit for environmental remediation . . . . . . . . . . . . . . . . . . . . . .

1

.00

2

Enter the development zones credit for job creation or retention . . . . . . . . . . . . . . . . . . . . . . . . .

2

.00

3

Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Enter wage subsidies from Wisconsin Worker trial job program, subsidies and reimbursements

.00

from the Real World, Real Pay pilot project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.00

5

Subtract line 4 from line 3 . This is the development zones credit before pass-through credits . .

5

6

Development zones credit passed through from other entities:

6a Entity Name

.00

FEIN

Amount 6a

6b Entity Name

.00

FEIN

Amount 6b

.00

6c Total pass through credits from additional schedule . . . . . . 6c

.00

6d Total credits (add lines 6a through 6c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6d

7

Add lines 5 and 6d . This is your 2015 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.00

7a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . .

.00

7a

.00

7b Fiduciaries - subtract line 7a from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

.00

8

Carryover of unused development zones credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Add lines 7 and 8 (lines 7b and 8 if fiduciary). This is the available development zones credit . .

.00

9

9

Part II

Development Opportunity Zone, Agricultural Development Zone, or Airport Development Zone Capital Investment Credit

10

Enter the purchase price of depreciable, tangible personal property purchased during the

taxable year that is used in the conduct of business in an opportunity zone, agricultural zone,

.00

or airport zone . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Enter the amount expended during the taxable year to acquire, construct, rehabilitate, remodel,

.00

or repair real property in an opportunity zone, agricultural zone, or airport zone . . . . . . . . . . . . . 11

.00

12

Add lines 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Multiply line 12 by 3% (0 .03) . This is the capital investment credit before pass-through credits . 13

.00

14

Capital investment credit passed through from other entities:

14a Entity Name

.00

FEIN

Amount 14a

14b Entity Name

.00

FEIN

Amount 14b

.00

14c Total pass through credits from additional schedule . . . . . . 14c

.00

14d Total credits (add lines 14a through 14c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14d

.00

15

Add lines 13 and 14d . This is your 2015 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

15a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . 15a

.00

.00

15b Fiduciaries - subtract line 15a from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15b

.00

16

Carryover of unused capital investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Add lines 15 and 16 (lines 15b and 16 if fiduciary). This is the available capital investment credit 17

17

.00

IC-032

1

1