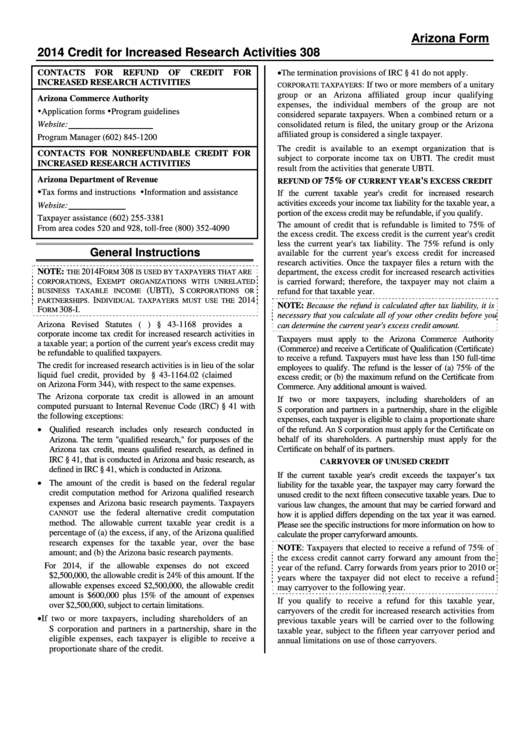

Instructions For Arizona Form 308 - Credit For Increased Research Activities - 2014

ADVERTISEMENT

Arizona Form

2014 Credit for Increased Research Activities

308

The termination provisions of IRC § 41 do not apply.

CONTACTS

FOR

REFUND

OF

CREDIT

FOR

INCREASED RESEARCH ACTIVITIES

: If two or more members of a unitary

CORPORATE TAXPAYERS

group or an Arizona affiliated group incur qualifying

Arizona Commerce Authority

expenses, the individual members of the group are not

Application forms Program guidelines

considered separate taxpayers. When a combined return or a

Website:

consolidated return is filed, the unitary group or the Arizona

affiliated group is considered a single taxpayer.

Program Manager

(602) 845-1200

The credit is available to an exempt organization that is

CONTACTS FOR NONREFUNDABLE CREDIT FOR

subject to corporate income tax on UBTI. The credit must

INCREASED RESEARCH ACTIVITIES

result from the activities that generate UBTI.

Arizona Department of Revenue

75%

'

REFUND OF

OF CURRENT YEAR

S EXCESS CREDIT

Tax forms and instructions Information and assistance

If the current taxable year's credit for increased research

activities exceeds your income tax liability for the taxable year, a

Website:

portion of the excess credit may be refundable, if you qualify.

Taxpayer assistance

(602) 255-3381

The amount of credit that is refundable is limited to 75% of

From area codes 520 and 928, toll-free

(800) 352-4090

the excess credit. The excess credit is the current year's credit

less the current year's tax liability. The 75% refund is only

General Instructions

available for the current year's excess credit for increased

research activities. Once the taxpayer files a return with the

NOTE:

2014 F

308

department, the excess credit for increased research activities

THE

ORM

IS USED BY TAXPAYERS THAT ARE

, E

is carried forward; therefore, the taxpayer may not claim a

CORPORATIONS

XEMPT ORGANIZATIONS WITH UNRELATED

(UBTI), S

refund for that taxable year.

BUSINESS TAXABLE INCOME

CORPORATIONS OR

. I

2014

PARTNERSHIPS

NDIVIDUAL TAXPAYERS MUST USE THE

NOTE: Because the refund is calculated after tax liability, it is

F

308-I.

ORM

necessary that you calculate all of your other credits before you

Arizona Revised Statutes (A.R.S.) § 43-1168 provides a

can determine the current year's excess credit amount.

corporate income tax credit for increased research activities in

Taxpayers must apply to the Arizona Commerce Authority

a taxable year; a portion of the current year's excess credit may

(Commerce) and receive a Certificate of Qualification (Certificate)

be refundable to qualified taxpayers.

to receive a refund. Taxpayers must have less than 150 full-time

The credit for increased research activities is in lieu of the solar

employees to qualify. The refund is the lesser of (a) 75% of the

liquid fuel credit, provided by A.R.S. § 43-1164.02 (claimed

excess credit; or (b) the maximum refund on the Certificate from

on Arizona Form 344), with respect to the same expenses.

Commerce. Any additional amount is waived.

The Arizona corporate tax credit is allowed in an amount

If two or more taxpayers, including shareholders of an

computed pursuant to Internal Revenue Code (IRC) § 41 with

S corporation and partners in a partnership, share in the eligible

the following exceptions:

expenses, each taxpayer is eligible to claim a proportionate share

Qualified research includes only research conducted in

of the refund. An S corporation must apply for the Certificate on

Arizona. The term "qualified research," for purposes of the

behalf of its shareholders. A partnership must apply for the

Certificate on behalf of its partners.

Arizona tax credit, means qualified research, as defined in

IRC § 41, that is conducted in Arizona and basic research, as

CARRYOVER OF UNUSED CREDIT

defined in IRC § 41, which is conducted in Arizona.

If the current taxable year's credit exceeds the taxpayer’s tax

The amount of the credit is based on the federal regular

liability for the taxable year, the taxpayer may carry forward the

credit computation method for Arizona qualified research

unused credit to the next fifteen consecutive taxable years. Due to

expenses and Arizona basic research payments. Taxpayers

various law changes, the amount that may be carried forward and

use the federal alternative credit computation

CANNOT

how it is applied differs depending on the tax year it was earned.

method. The allowable current taxable year credit is a

Please see the specific instructions for more information on how to

percentage of (a) the excess, if any, of the Arizona qualified

calculate the proper carryforward amounts.

research expenses for the taxable year, over the base

NOTE: Taxpayers that elected to receive a refund of 75% of

amount; and (b) the Arizona basic research payments.

the excess credit cannot carry forward any amount from the

For 2014, if the allowable expenses do not exceed

year of the refund. Carry forwards from years prior to 2010 or

$2,500,000, the allowable credit is 24% of this amount. If the

years where the taxpayer did not elect to receive a refund

allowable expenses exceed $2,500,000, the allowable credit

may carryover to the following year.

amount is $600,000 plus 15% of the amount of expenses

If you qualify to receive a refund for this taxable year,

over $2,500,000, subject to certain limitations.

carryovers of the credit for increased research activities from

If two or more taxpayers, including shareholders of an

previous taxable years will be carried over to the following

S corporation and partners in a partnership, share in the

taxable year, subject to the fifteen year carryover period and

eligible expenses, each taxpayer is eligible to receive a

annual limitations on use of those carryovers.

proportionate share of the credit.

ADVERTISEMENT

0 votes

Related Articles

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5