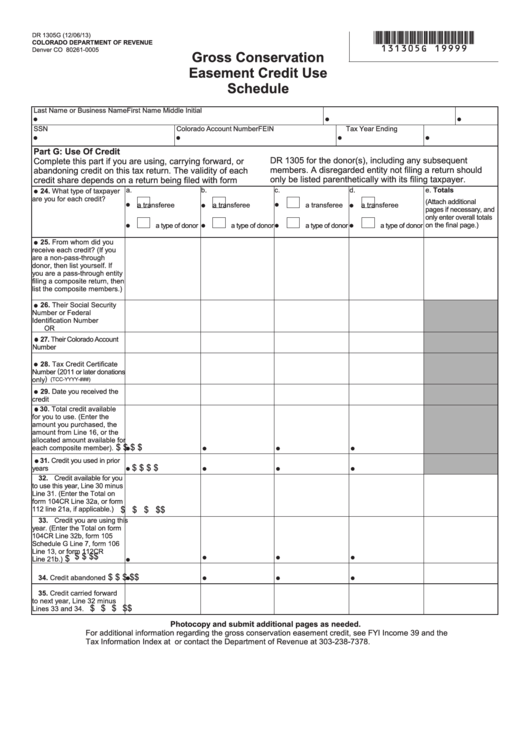

DR 1305G (12/06/13)

*131305G=19999*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

Gross Conservation

Easement Credit Use

Schedule

Last Name or Business Name

First Name

Middle Initial

SSN

Colorado Account Number

FEIN

Tax Year Ending

Part G: Use Of Credit

DR 1305 for the donor(s), including any subsequent

Complete this part if you are using, carrying forward, or

members. A disregarded entity not filing a return should

abandoning credit on this tax return. The validity of each

only be listed parenthetically with its filing taxpayer.

credit share depends on a return being filed with form

a.

b.

c.

d.

e. Totals

24. What type of taxpayer

are you for each credit?

(Attach additional

a transferee

a transferee

a transferee

a transferee

pages if necessary, and

only enter overall totals

on the final page.)

a type of donor

a type of donor

a type of donor

a type of donor

25. From whom did you

receive each credit? (If you

are a non-pass-through

donor, then list yourself. If

you are a pass-through entity

filing a composite return, then

list the composite members.)

26. Their Social Security

Number or Federal

Identification Number

OR

27. Their Colorado Account

Number

28. Tax Credit Certificate

Number ( 2011 or later donations

only )

(TCC-YYYY-###)

29. Date you received the

credit

30. Total credit available

for you to use. (Enter the

amount you purchased, the

amount from Line 16, or the

allocated amount available for

$

$

$

$

each composite member).

31. Credit you used in prior

$

$

$

$

years

32. Credit available for you

to use this year, Line 30 minus

Line 31. (Enter the Total on

form 104CR Line 32a, or form

$

$

$

$

$

112 line 21a, if applicable.)

33. Credit you are using this

year. (Enter the Total on form

104CR Line 32b, form 105

Schedule G Line 7, form 106

Line 13, or form 112CR

$

$

$

$

$

Line 21b.)

$

$

$

$

$

34. Credit abandoned

35. Credit carried forward

to next year, Line 32 minus

$

$

$

$

$

Lines 33 and 34.

Photocopy and submit additional pages as needed.

For additional information regarding the gross conservation easement credit, see FYI Income 39 and the

Tax Information Index at or contact the Department of Revenue at 303-238-7378.

1

1