Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

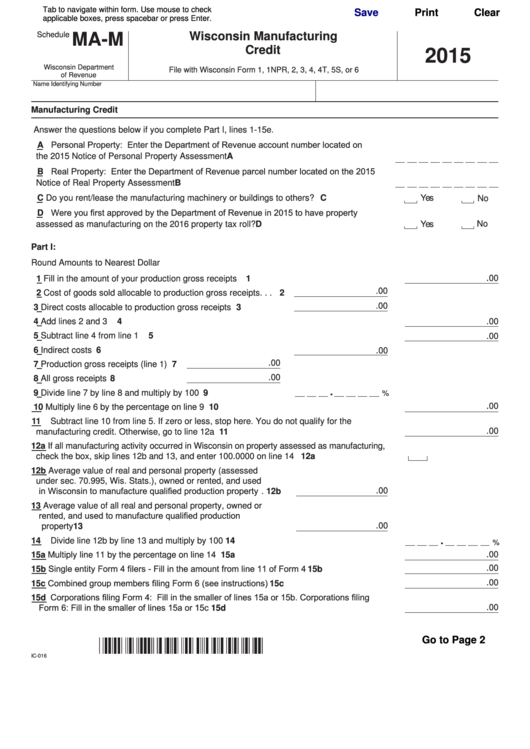

Schedule

Wisconsin Manufacturing

MA-M

Credit

2015

Wisconsin Department

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

of Revenue

Name

Identifying Number

Manufacturing Credit

Answer the questions below if you complete Part I, lines 1-15e .

A Personal Property: Enter the Department of Revenue account number located on

the 2015 Notice of Personal Property Assessment . . . . . . . . . . . . . . . . . . . . . . . . . . . . A

B Real Property: Enter the Department of Revenue parcel number located on the 2015

Notice of Real Property Assessment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B

C Do you rent/lease the manufacturing machinery or buildings to others? . . . . . . . . . . . . C

Yes

No

D Were you first approved by the Department of Revenue in 2015 to have property

assessed as manufacturing on the 2016 property tax roll? . . . . . . . . . . . . . . . . . . . . . . D

Yes

No

Part I:

Round Amounts to Nearest Dollar

.

00

1

Fill in the amount of your production gross receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

.00

2

Cost of goods sold allocable to production gross receipts . . . 2

.00

3

Direct costs allocable to production gross receipts . . . . . . . . 3

.

00

4

Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Subtract line 4 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

00

6

Indirect costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.

00

.

00

7

Production gross receipts (line 1) 7

.

00

8

All gross receipts . . . . . . . . . . . . 8

.

9

Divide line 7 by line 8 and multiply by 100 . . . . . . . . . . . . . . . 9

%

.

00

10

Multiply line 6 by the percentage on line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Subtract line 10 from line 5 . If zero or less, stop here . You do not qualify for the

.

00

manufacturing credit . Otherwise, go to line 12a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12a If all manufacturing activity occurred in Wisconsin on property assessed as manufacturing,

check the box, skip lines 12b and 13, and enter 100 .0000 on line 14 . . . . . . . . . . . . . . . 12a

12b Average value of real and personal property (assessed

under sec . 70 .995, Wis . Stats .), owned or rented, and used

in Wisconsin to manufacture qualified production property . 12b

.

00

13

Average value of all real and personal property, owned or

rented, and used to manufacture qualified production

.

00

property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

.

14

Divide line 12b by line 13 and multiply by 100 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

%

.

00

15a Multiply line 11 by the percentage on line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15a

15b Single entity Form 4 filers - Fill in the amount from line 11 of Form 4 . . . . . . . . . . . . . . . 15b

.

00

15c Combined group members filing Form 6 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 15c

.

00

15d Corporations filing Form 4: Fill in the smaller of lines 15a or 15b. Corporations filing

Form 6: Fill in the smaller of lines 15a or 15c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15d

.

00

Go to Page 2

IC-016

1

1 2

2