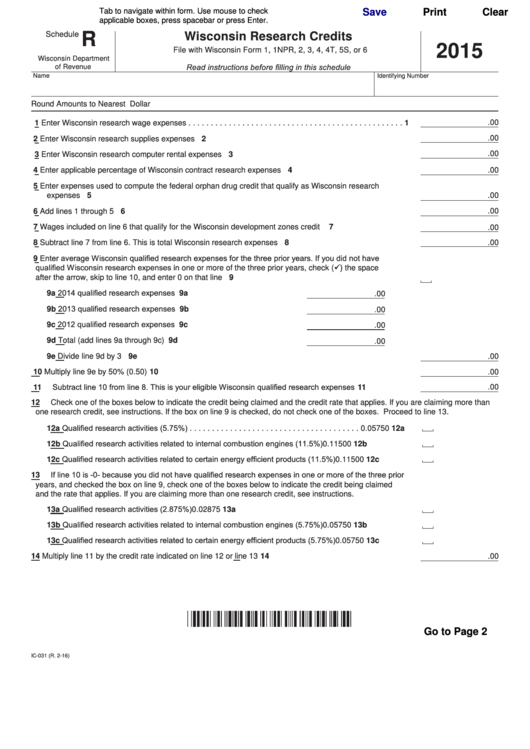

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Schedule

R

Wisconsin Research Credits

2015

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

Round Amounts to Nearest Dollar

.00

1

Enter Wisconsin research wage expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

2

Enter Wisconsin research supplies expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

3

Enter Wisconsin research computer rental expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.00

4

Enter applicable percentage of Wisconsin contract research expenses . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Enter expenses used to compute the federal orphan drug credit that qualify as Wisconsin research

expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6

Add lines 1 through 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.00

7

Wages included on line 6 that qualify for the Wisconsin development zones credit . . . . . . . . . . . . . . . . . 7

.00

.00

8

Subtract line 7 from line 6. This is total Wisconsin research expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Enter average Wisconsin qualified research expenses for the three prior years. If you did not have

9

qualified Wisconsin research expenses in one or more of the three prior years, check

()

the space

after the arrow, skip to line 10, and enter 0 on that line. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9a 2014 qualified research expenses . . . . . . . . . . . . . . . . . . . . . . . . 9a

.00

9b 2013 qualified research expenses . . . . . . . . . . . . . . . . . . . . . . . . 9b

.00

9c 2012 qualified research expenses . . . . . . . . . . . . . . . . . . . . . . . . 9c

.00

9d Total (add lines 9a through 9c). . . . . . . . . . . . . . . . . . . . . . . . . . . 9d

.00

9e Divide line 9d by 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9e

.00

10

Multiply line 9e by 50% (0.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

Subtract line 10 from line 8. This is your eligible Wisconsin qualified research expenses . . . . . . . . . . . . 11

.00

11

12

Check one of the boxes below to indicate the credit being claimed and the credit rate that applies. If you are claiming more than

one research credit, see instructions. If the box on line 9 is checked, do not check one of the boxes. Proceed to line 13.

12a Qualified research activities (5.75%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.05750

12a

12b Qualified research activities related to internal combustion engines (11.5%) . . . . . . . 0.11500

12b

12c Qualified research activities related to certain energy efficient products (11.5%) . . . . 0.11500

12c

If line 10 is -0- because you did not have qualified research expenses in one or more of the three prior

13

years, and checked the box on line 9, check one of the boxes below to indicate the credit being claimed

and the rate that applies. If you are claiming more than one research credit, see instructions.

13a Qualified research activities (2.875%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.02875

13a

13b Qualified research activities related to internal combustion engines (5.75%) . . . . . . . 0.05750

13b

13c Qualified research activities related to certain energy efficient products (5.75%) . . . . 0.05750

13c

14

Multiply line 11 by the credit rate indicated on line 12 or line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.00

Go to Page 2

IC-031 (R. 2-16)

1

1 2

2