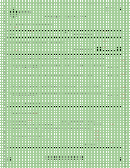

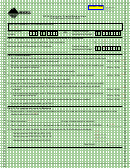

Form RCYL Instructions

products from reclaimed material or for treating soils contaminated

Defi nitions

by hazardous wastes.

Collect refers to the collection and delivery of reclaimed materials

The basis for the credit is generally the cost of the property before

to a recycling or reclaimable materials processing facility.

any reduction you might have received from the seller by trading

Machinery or equipment refers to property used in the collection

in old equipment. If, however, you received a previous credit

or processing of reclaimable material or in the manufacturing of a

on the equipment you traded in, the basis for the credit would

product from reclaimed material. This property has a depreciable

be the cost of the property after factoring in the reduction you

life of more than one year.

received on the trade-in. The basis includes the purchase price,

Reclaimable material refers to material that still has useful

transportation cost (if paid by the purchaser) and the installation

physical or chemical properties after serving its original purpose

cost before depreciation or other reductions. This credit does not

and that a consumer, processor or manufacturer would normally

increase or decrease the basis for tax purposes.

treat as solid waste and dispose of.

Recycling machinery and equipment must be located and

Recycled material refers to a substance that is produced from

operating in Montana on the last day of the taxable year for

reclaimed material. The person who generated the reclaimed

which the credit is claimed. The machinery must be used to

material that was collected, processed or used to manufacture a

collect, process, separate, modify or treat solid waste so that it

product may not claim the tax credit.

can be converted into a product that can be used in place of a

raw material or be used to treat soils contaminated by hazardous

How do I claim my credit when I am a partner or

wastes. This does not include transportation equipment unless it

shareholder in a partnership or an S corporation

is specialized to the point that it can only be used to collect and

that invested in the depreciable property used for

process reclaimable material.

recycling?

If the credit exceeds my tax liability, can I carry

Your partnership or S corporation will report the credit on its

any excess credit to another tax year?

informational tax return and provide you with your portion of the

No. The credit is limited to the amount of the taxpayer’s individual

credit on Montana Schedule K-1.

or corporation tax liability. Any excess credit is not refundable and

If you are a partner, your portion of the credit is based on the

cannot be carried back or forward to other tax years.

same proportion you use to report your income or loss from the

partnership for Montana tax purposes unless the partners have

Are there other limitations concerning the recycle

an agreement providing for a different allocation. If you are a

credit?

shareholder, your portion of the credit is based on the pro rata

The Department of Revenue may disallow a credit resulting from

share of the corporation’s cost of investing in the equipment.

a sale or lease when the overriding purpose of the transaction is

For example, if your business is an S corporation with four

not to collect or process reclaimable material or manufacture a

shareholders with equal ownership interest, each shareholder

product from reclaimed material.

would be entitled to 25% of the total credit.

The credit may not be claimed for an investment in property used

Only a taxpayer that owns an interest either directly or through a

to produce energy from reclaimed material.

pass-through entity, such as a partnership or S corporation, and is

What information do I have to include with my tax

operating the equipment as the primary user on the last business

return when I claim this credit?

day of the year, may claim the credit.

Individuals and C corporations fi ling paper returns must include

Part I. Partners in a Partnership or Shareholders

a completed Form RCYL. S corporations and partnerships fi ling

of an S Corporation

paper information returns must include, in addition to a completed

Form RCYL, a separate statement identifying each owner and

If you complete Part I, do not complete Parts II, III or IV unless

their portion of the credit.

you have additional credit amounts that you did not receive as

a distribution from a partnership or S corporation. If you are

In addition, if you are claiming a credit in Part III or Part IV, you will

a partner or shareholder in more than one partnership or S

also need to provide a copy of the sales receipt, any pamphlets

corporation, you will need to complete a separate Form RCYL for

on the equipment purchased, and any other information regarding

each entity you are receiving a credit from.

what the equipment is and how it is used in collecting, processing

or manufacturing reclaimed material.

Parts II, III and IV. Qualifi cations and Credit

Computation

Part V. Recycling Deduction Instructions

This credit is available to qualifying C corporations, S corporations,

You may deduct an additional amount equal to 10% of your

partnerships and individuals.

expenditures for the purchase of recycled material that you could

otherwise deduct as a business-related expense in Montana. The

What costs do I use to calculate my recycling

products have to contain recycled material at a level consistent

credit?

with industry standards or with standards established by the

Use the costs of the investment that you have made in the

federal Environmental Protection Agency (if those standards

qualifying equipment that you used to calculate your depreciation

exist).

deduction for federal income tax purposes.

Include a statement from the manufacturer or supplier stating the

The tax credit is available only for machinery and equipment that

amount of recycled material contained in the material or product

is depreciable (defi ned in IRS Code Section 167). The machinery

purchased.

and equipment must be used in Montana, primarily for collecting

Administrative Rules of Montana: 42.4.2601 through 42.4.2605

or processing reclaimable material for manufacturing fi nished

Questions? Please call us toll free at (866) 859-2254 (in Helena,

444-6900).

1

1 2

2 3

3