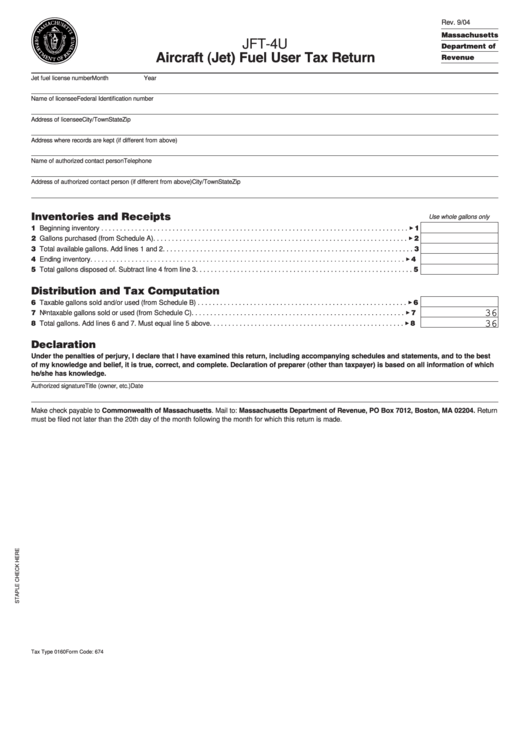

Rev. 9/04

Massachusetts

JFT-4U

Department of

Aircraft (Jet) Fuel User Tax Return

Revenue

Jet fuel license number

Month

Year

Name of licensee

Federal Identification number

Address of licensee

City/Town

State

Zip

Address where records are kept (if different from above)

Name of authorized contact person

Telephone

Address of authorized contact person (if different from above)

City/Town

State

Zip

Inventories and Receipts

Use whole gallons only

1 Beginning inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Gallons purchased (from Schedule A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Total available gallons. Add lines 1 and 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Ending inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Total gallons disposed of. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Distribution and Tax Computation

6 Taxable gallons sold and/or used (from Schedule B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

36

7 Nontaxable gallons sold or used (from Schedule C). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

36

8 Total gallons. Add lines 6 and 7. Must equal line 5 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

Declaration

Under the penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which

he/she has knowledge.

Authorized signature

Title (owner, etc.)

Date

Make check payable to Commonwealth of Massachusetts. Mail to: Massachusetts Department of Revenue, PO Box 7012, Boston, MA 02204. Return

must be filed not later than the 20th day of the month following the month for which this return is made.

Tax Type 0160 Form Code: 674

1

1 2

2 3

3 4

4