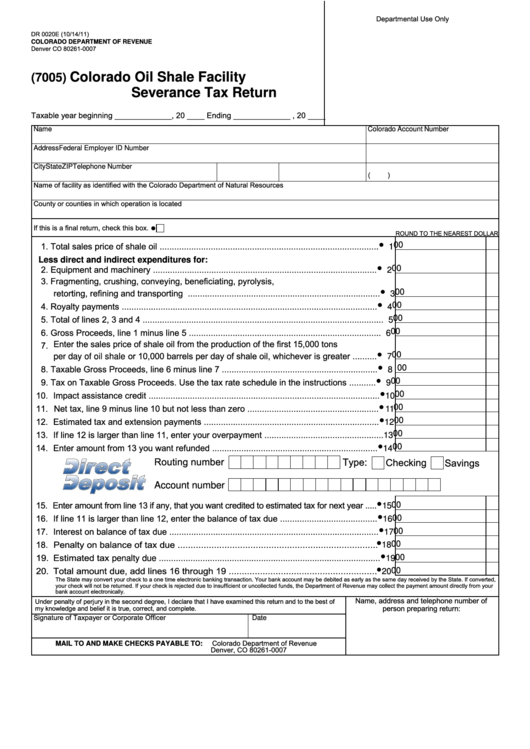

Departmental use only

DR 0020e (10/14/11)

COLOradO deParTMenT Of revenue

Denver Co 80261-0007

Colorado Oil shale facility

(7005)

severance Tax return

taxable year beginning _____________, 20 ____ ending _____________ , 20 ____

Name

Colorado Account Number

Address

Federal Employer ID Number

City

State

ZIP

Telephone Number

(

)

Name of facility as identified with the Colorado Department of Natural Resources

County or counties in which operation is located

•

If this is a final return, check this box.

RouND to the NeaRest DollaR

•

1. total sales price of shale oil ..........................................................................................

00

1

Less direct and indirect expenditures for:

•

2. equipment and machinery ............................................................................................

00

2

3. Fragmenting, crushing, conveying, beneficiating, pyrolysis,

•

retorting, refining and transporting ...............................................................................

00

3

•

4. Royalty payments .........................................................................................................

00

4

5. total of lines 2, 3 and 4 ................................................................................................... 5

00

6. Gross Proceeds, line 1 minus line 5 ............................................................................... 6

00

7. enter the sales price of shale oil from the production of the first 15,000 tons

•

per day of oil shale or 10,000 barrels per day of shale oil, whichever is greater ..........

00

7

•

8. taxable Gross Proceeds, line 6 minus line 7 ................................................................

00

8

•

9. tax on taxable Gross Proceeds. use the tax rate schedule in the instructions ...........

00

9

•

10. Impact assistance credit ...............................................................................................

00

10

•

11. Net tax, line 9 minus line 10 but not less than zero ......................................................

00

11

•

12. estimated tax and extension payments ........................................................................

00

12

13. If line 12 is larger than line 11, enter your overpayment ................................................. 13

00

•

14. enter amount from 13 you want refunded ....................................................................

00

14

Routing number

Checking

savings

Type:

Account number

•

15. enter amount from line 13 if any, that you want credited to estimated tax for next year .....

00

15

•

16. If line 11 is larger than line 12, enter the balance of tax due ........................................

00

16

•

17. Interest on balance of tax due ......................................................................................

00

17

•

18. Penalty on balance of tax due .............................................................................

00

18

•

19. estimated tax penalty due ...........................................................................................

00

19

•

20. total amount due, add lines 16 through 19 .........................................................

00

20

the state may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the state. If converted,

your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your

bank account electronically.

Name, address and telephone number of

under penalty of perjury in the second degree, I declare that I have examined this return and to the best of

person preparing return:

my knowledge and belief it is true, correct, and complete.

signature of taxpayer or Corporate officer

Date

Colorado Department of Revenue

MaiL TO and Make CheCks PayabLe TO:

Denver, Co 80261-0007

1

1 2

2