Form 4901 - Michigan Corporate Income Tax E-File Annual Return Payment Voucher

ADVERTISEMENT

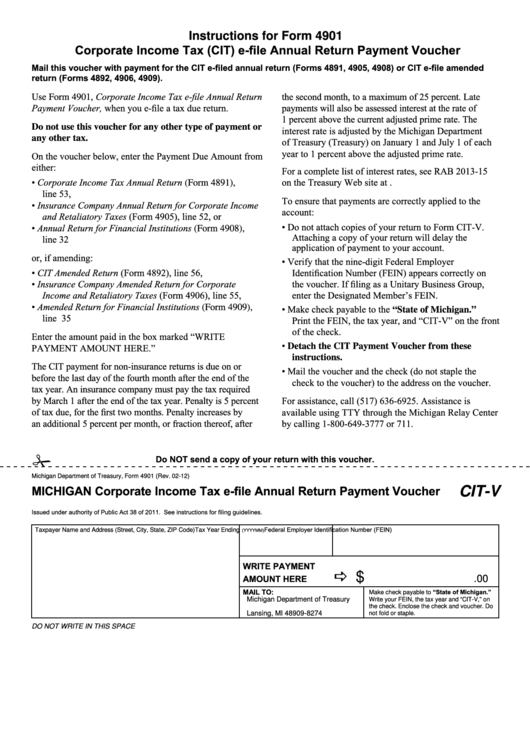

Instructions for Form 4901

Corporate Income Tax (CIT) e-file Annual Return Payment Voucher

Mail this voucher with payment for the CIT e-filed annual return (Forms 4891, 4905, 4908) or CIT e-file amended

return (Forms 4892, 4906, 4909).

Use Form 4901, Corporate Income Tax e-file Annual Return

the second month, to a maximum of 25 percent. Late

Payment Voucher, when you e-file a tax due return.

payments will also be assessed interest at the rate of

1 percent above the current adjusted prime rate. The

Do not use this voucher for any other type of payment or

interest rate is adjusted by the Michigan Department

any other tax.

of Treasury (Treasury) on January 1 and July 1 of each

year to 1 percent above the adjusted prime rate.

On the voucher below, enter the Payment Due Amount from

either:

For a complete list of interest rates, see RAB 2013-15

• Corporate Income Tax Annual Return (Form 4891),

on the Treasury Web site at

line 53,

To ensure that payments are correctly applied to the

• Insurance Company Annual Return for Corporate Income

account:

and Retaliatory Taxes (Form 4905), line 52, or

• Do not attach copies of your return to Form CIT-V.

• Annual Return for Financial Institutions (Form 4908),

Attaching a copy of your return will delay the

line 32

application of payment to your account.

or, if amending:

• Verify that the nine-digit Federal Employer

• CIT Amended Return (Form 4892), line 56,

Identification Number (FEIN) appears correctly on

• Insurance Company Amended Return for Corporate

the voucher. If filing as a Unitary Business Group,

enter the Designated Member’s FEIN.

Income and Retaliatory Taxes (Form 4906), line 55,

• Amended Return for Financial Institutions (Form 4909),

• Make check payable to the “State of Michigan.”

line 35

Print the FEIN, the tax year, and “CIT-V” on the front

of the check.

Enter the amount paid in the box marked “WRITE

• Detach the CIT Payment Voucher from these

PAYMENT AMOUNT HERE.”

instructions.

The CIT payment for non-insurance returns is due on or

• Mail the voucher and the check (do not staple the

before the last day of the fourth month after the end of the

check to the voucher) to the address on the voucher.

tax year. An insurance company must pay the tax required

by March 1 after the end of the tax year. Penalty is 5 percent

For assistance, call (517) 636-6925. Assistance is

of tax due, for the first two months. Penalty increases by

available using TTY through the Michigan Relay Center

an additional 5 percent per month, or fraction thereof, after

by calling 1-800-649-3777 or 711.

#

Do NOT send a copy of your return with this voucher.

Michigan Department of Treasury, Form 4901 (Rev. 02-12)

MICHIGAN Corporate Income Tax e-file Annual Return Payment Voucher

CIT-V

Issued under authority of Public Act 38 of 2011. See instructions for filing guidelines.

Federal Employer Identification Number (FEIN)

Taxpayer Name and Address (Street, City, State, ZIP Code)

Tax Year Ending

(YYYYMM)

WRITE PAYMENT

a $

AMOUNT HERE

.00

MAIL TO:

Make check payable to “State of Michigan.”

Michigan Department of Treasury

Write your FEIN, the tax year and “CIT-V,” on

P.O. Box 30774

the check. Enclose the check and voucher. Do

Lansing, MI 48909-8274

not fold or staple.

DO NOT WRITE IN THIS SPACE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1