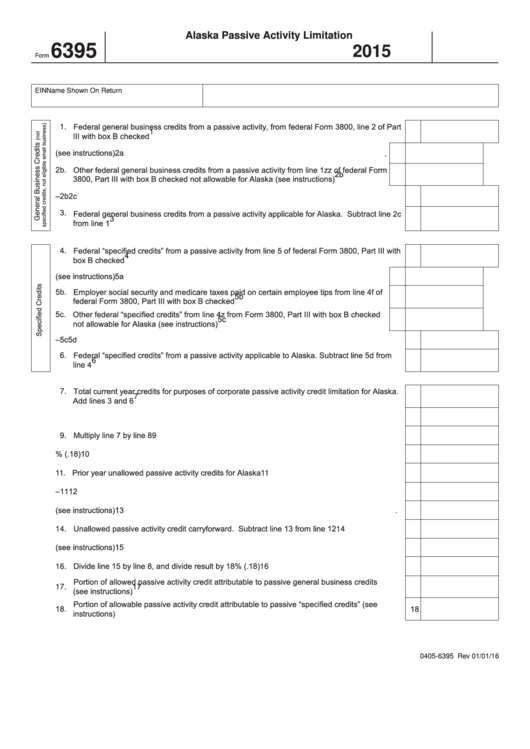

Form 6395 - Alaska Passive Activity Limitation - 2015

ADVERTISEMENT

Alaska Passive Activity Limitation

6395

2015

Form

EIN

Name Shown On Return

1. Federal general business credits from a passive activity, from federal Form 3800, line 2 of Part

1

III with box B checked

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2a. Federal investment credit from a passive activity not allowable for Alaska (see instructions)

2a

.

2b. Other federal general business credits from a passive activity from line 1zz of federal Form

2b

3800, Part III with box B checked not allowable for Alaska (see instructions)

.

.

.

.

.

2c. Add lines 2a–2b

2c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3. Federal general business credits from a passive activity applicable for Alaska. Subtract line 2c

3

from line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4. Federal “specified credits” from a passive activity from line 5 of federal Form 3800, Part III with

4

box B checked

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5a. Federal investment credit from a passive activity not allowable for Alaska (see instructions)

5a

5b. Employer social security and medicare taxes paid on certain employee tips from line 4f of

5b

federal Form 3800, Part III with box B checked

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5c. Other federal “specified credits” from line 4z from Form 3800, Part III with box B checked

5c

not allowable for Alaska (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5d. Add lines 5a–5c

5d

6. Federal “specified credits” from a passive activity applicable to Alaska. Subtract line 5d from

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

line 4

7. Total current year credits for purposes of corporate passive activity credit limitation for Alaska.

7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Add lines 3 and 6

8. Apportionment factor

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9. Multiply line 7 by line 8

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10. Total current apportioned general business credit. Multiply line 9 by 18% (.18)

10

.

.

.

.

.

11. Prior year unallowed passive activity credits for Alaska

.

.

.

.

.

.

.

.

.

.

.

.

.

11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12. Add lines 10–11

12

13. Enter Alaska tax attributable to net passive income and net active income (see instructions)

.

13

14. Unallowed passive activity credit carryforward. Subtract line 13 from line 12

14

.

.

.

.

.

.

15. Allowed passive activity credit. Subtract line 14 from line 12 (see instructions)

15

.

.

.

.

.

16. Divide line 15 by line 8, and divide result by 18% (.18)

16

.

.

.

.

.

.

.

.

.

.

.

.

.

Portion of allowed passive activity credit attributable to passive general business credits

17.

17

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Portion of allowable passive activity credit attributable to passive “specified credits” (see

18.

18

instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0405-6395 Rev 01/01/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1