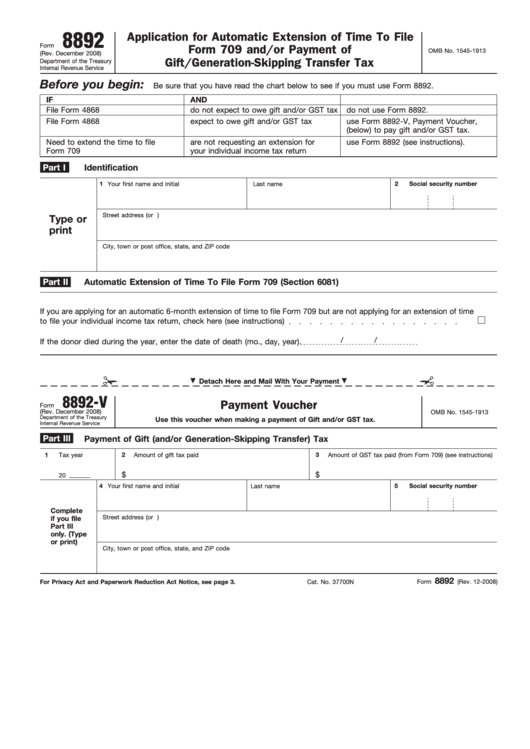

8892

Application for Automatic Extension of Time To File

Form

Form 709 and/or Payment of

OMB No. 1545-1913

(Rev. December 2008)

Gift/Generation-Skipping Transfer Tax

Department of the Treasury

Internal Revenue Service

Before you begin:

Be sure that you have read the chart below to see if you must use Form 8892.

IF you...

AND you...

THEN...

File Form 4868

do not expect to owe gift and/or GST tax

do not use Form 8892.

File Form 4868

expect to owe gift and/or GST tax

use Form 8892-V, Payment Voucher,

(below) to pay gift and/or GST tax.

Need to extend the time to file

are not requesting an extension for

use Form 8892 (see instructions).

Form 709

your individual income tax return

Part I

Identification

1

Your first name and initial

Last name

2

Social security number

Street address (or P.O. box if mail is not delivered to street address)

Type or

print

City, town or post office, state, and ZIP code

Part II

Automatic Extension of Time To File Form 709 (Section 6081)

If you are applying for an automatic 6-month extension of time to file Form 709 but are not applying for an extension of time

to file your individual income tax return, check here (see instructions)

/

/

If the donor died during the year, enter the date of death (mo., day, year)

.

Detach Here and Mail With Your Payment

8892-V

Payment Voucher

Form

(Rev. December 2008)

OMB No. 1545-1913

Department of the Treasury

Use this voucher when making a payment of Gift and/or GST tax.

Internal Revenue Service

Part III

Payment of Gift (and/or Generation-Skipping Transfer) Tax

1

Tax year

2

Amount of gift tax paid

3

Amount of GST tax paid (from Form 709) (see instructions)

$

$

20

4

Your first name and initial

Last name

5

Social security number

Complete

Street address (or P.O. box if mail is not delivered to street address)

if you file

Part III

only. (Type

or print)

City, town or post office, state, and ZIP code

8892

For Privacy Act and Paperwork Reduction Act Notice, see page 3.

Cat. No. 37700N

Form

(Rev. 12-2008)

1

1 2

2 3

3