Form 841me - Certified Visual Media Production Wage Reimbursement Application

ADVERTISEMENT

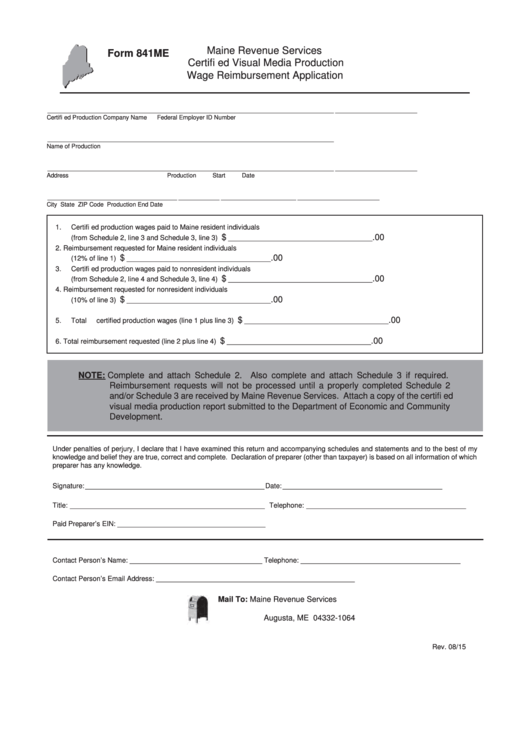

Maine Revenue Services

Form 841ME

Certifi ed Visual Media Production

Wage Reimbursement Application

____________________________________________________________________________________

________________________

Certifi ed Production Company Name

Federal Employer ID Number

____________________________________________________________________________________

Name of Production

____________________________________________________________________________________

________________________

Address

Production Start Date

______________________________________

____________

______________________

________________________

City

State

ZIP Code

Production End Date

1.

Certifi ed production wages paid to Maine resident individuals

$

.00

(from Schedule 2, line 3 and Schedule 3, line 3) .............................. 1.

_____________________________________

2.

Reimbursement requested for Maine resident individuals

$

.00

(12% of line 1) .................................................................................. 2.

_____________________________________

3.

Certifi ed production wages paid to nonresident individuals

$

.00

(from Schedule 2, line 4 and Schedule 3, line 4) .............................. 3.

_____________________________________

4.

Reimbursement requested for nonresident individuals

$

.00

(10% of line 3) .................................................................................. 4.

_____________________________________

$

.00

5.

Total certifi ed production wages (line 1 plus line 3) .......................... 5.

_____________________________________

$

.00

6.

Total reimbursement requested (line 2 plus line 4) ........................... 6.

_____________________________________

NOTE: Complete and attach Schedule 2. Also complete and attach Schedule 3 if required.

Reimbursement requests will not be processed until a properly completed Schedule 2

and/or Schedule 3 are received by Maine Revenue Services. Attach a copy of the certifi ed

visual media production report submitted to the Department of Economic and Community

Development.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my

knowledge and belief they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which

preparer has any knowledge.

Signature: ______________________________________________

Date: _________________________________________

Title: __________________________________________________

Telephone: _________________________________________

Paid Preparer’s EIN: ______________________________________

Contact Person’s Name: __________________________________

Telephone: _________________________________________

Contact Person’s Email Address: ___________________________________________________

Mail To:

Maine Revenue Services

P.O. Box 1064

Augusta, ME 04332-1064

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5