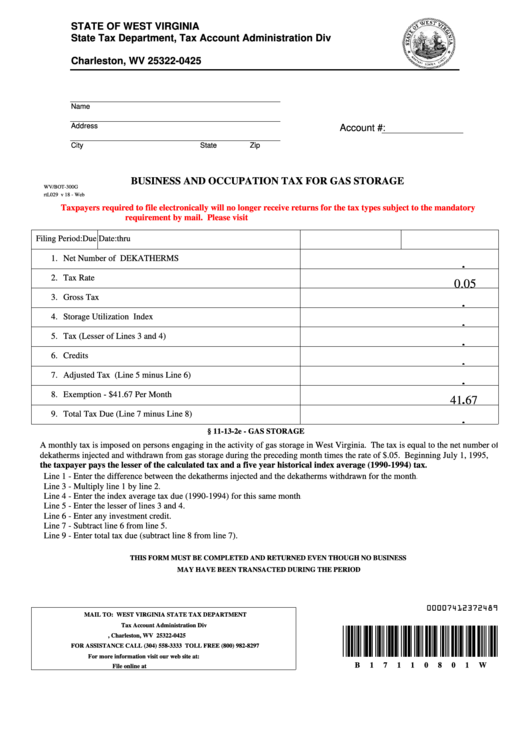

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address

Account #:

City

State

Zip

BUSINESS AND OCCUPATION TAX FOR GAS STORAGE

WV/BOT-300G

rtL029 v 18 - Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory

requirement by mail. Please visit for additional information.

Filing Period:

thru

Due Date:

1.

Net Number of DEKATHERMS

.

2.

Tax Rate

0.05

3.

Gross Tax

.

4.

Storage Utilization Index

.

5.

Tax (Lesser of Lines 3 and 4)

.

6.

Credits

.

7.

Adjusted Tax (Line 5 minus Line 6)

.

8.

Exemption - $41.67 Per Month

.

41 67

9.

Total Tax Due (Line 7 minus Line 8)

.

§ 11-13-2e - GAS STORAGE

A monthly tax is imposed on persons engaging in the activity of gas storage in West Virginia. The tax is equal to the net number of

dekatherms injected and withdrawn from gas storage during the preceding month times the rate of $.05. Beginning July 1, 1995,

the taxpayer pays the lesser of the calculated tax and a five year historical index average (1990-1994) tax.

Line 1 - Enter the difference between the dekatherms injected and the dekatherms withdrawn for the month.

Line 3 - Multiply line 1 by line 2.

Line 4 - Enter the index average tax due (1990-1994) for this same month.

Line 5 - Enter the lesser of lines 3 and 4.

Line 6 - Enter any investment credit.

Line 7 - Subtract line 6 from line 5.

Line 9 - Enter total tax due (subtract line 8 from line 7).

THIS FORM MUST BE COMPLETED AND RETURNED EVEN THOUGH NO BUSINESS

MAY HAVE BEEN TRANSACTED DURING THE PERIOD

00007412372489

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

B

1

7

1

1

0

8

0

1

W

File online at https://mytaxes.wvtax.gov

1

1 2

2