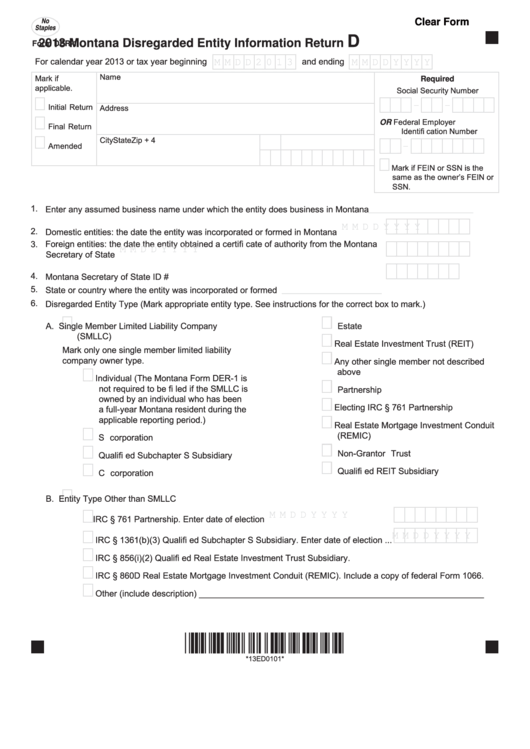

No

Clear Form

Staples

D

2013 Montana Disregarded Entity Information Return

Form DER-1

For calendar year 2013 or tax year beginning

and ending

M M D D 2 0 1 3

M M D D Y Y Y Y

Name

Mark if

Required

applicable.

Social Security Number

-

-

Initial Return

Address

Federal Employer

OR

Final Return

Identifi cation Number

City

State Zip + 4

Amended

-

Mark if FEIN or SSN is the

same as the owner’s FEIN or

SSN.

1. Enter any assumed business name under which the entity does business in Montana

______________________

M M D D Y Y Y Y

2. Domestic entities: the date the entity was incorporated or formed in Montana ...............

3. Foreign entities: the date the entity obtained a certifi cate of authority from the Montana

M M D D Y Y Y Y

Secretary of State ............................................................................................................

4. Montana Secretary of State ID # .....................................................................................

5. State or country where the entity was incorporated or formed ........................................

_____________________

6. Disregarded Entity Type (Mark appropriate entity type. See instructions for the correct box to mark.)

A.

Single Member Limited Liability Company

Estate

(SMLLC)

Real Estate Investment Trust (REIT)

Mark only one single member limited liability

company owner type.

Any other single member not described

above

Individual (The Montana Form DER-1 is

not required to be fi led if the SMLLC is

Partnership

owned by an individual who has been

Electing IRC § 761 Partnership

a full-year Montana resident during the

applicable reporting period.)

Real Estate Mortgage Investment Conduit

(REMIC)

S corporation

Non-Grantor Trust

Qualifi ed Subchapter S Subsidiary

Qualifi ed REIT Subsidiary

C corporation

B.

Entity Type Other than SMLLC

M M D D Y Y Y Y

IRC § 761 Partnership. Enter date of election ..................................................

M M D D Y Y Y Y

IRC § 1361(b)(3) Qualifi ed Subchapter S Subsidiary. Enter date of election ...

IRC § 856(i)(2) Qualifi ed Real Estate Investment Trust Subsidiary.

IRC § 860D Real Estate Mortgage Investment Conduit (REMIC). Include a copy of federal Form 1066.

Other (include description) ____________________________________________________________

*13ED0101*

*13ED0101*

1

1 2

2 3

3 4

4 5

5 6

6