5884

OMB No. 1545-0219

Work Opportunity Credit

2013

Form

Attach to your tax return.

▶

Department of the Treasury

Attachment

Information about Form 5884 and its instructions is at

▶

77

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

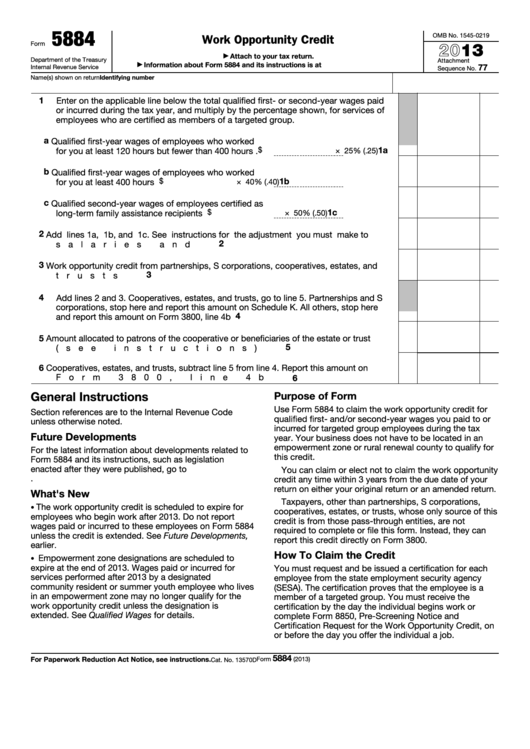

1

Enter on the applicable line below the total qualified first- or second-year wages paid

or incurred during the tax year, and multiply by the percentage shown, for services of

employees who are certified as members of a targeted group.

a Qualified first-year wages of employees who worked

1a

$

for you at least 120 hours but fewer than 400 hours .

× 25% (.25)

b Qualified first-year wages of employees who worked

1b

$

for you at least 400 hours

. . . . . . . . . .

× 40% (.40)

c Qualified second-year wages of employees certified as

1c

$

long-term family assistance recipients . . . . . .

× 50% (.50)

2

Add lines 1a, 1b, and 1c. See instructions for the adjustment you must make to

2

salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . .

3

Work opportunity credit from partnerships, S corporations, cooperatives, estates, and

3

trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Add lines 2 and 3. Cooperatives, estates, and trusts, go to line 5. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, stop here

4

and report this amount on Form 3800, line 4b . . . . . . . . . . . . . . .

5

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

5

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Cooperatives, estates, and trusts, subtract line 5 from line 4. Report this amount on

Form 3800, line 4b . . . . . . . . . . . . . . . . . . . . . . . . .

6

General Instructions

Purpose of Form

Use Form 5884 to claim the work opportunity credit for

Section references are to the Internal Revenue Code

qualified first- and/or second-year wages you paid to or

unless otherwise noted.

incurred for targeted group employees during the tax

Future Developments

year. Your business does not have to be located in an

empowerment zone or rural renewal county to qualify for

For the latest information about developments related to

this credit.

Form 5884 and its instructions, such as legislation

enacted after they were published, go to

You can claim or elect not to claim the work opportunity

credit any time within 3 years from the due date of your

return on either your original return or an amended return.

What's New

Taxpayers, other than partnerships, S corporations,

The work opportunity credit is scheduled to expire for

•

cooperatives, estates, or trusts, whose only source of this

employees who begin work after 2013. Do not report

credit is from those pass-through entities, are not

wages paid or incurred to these employees on Form 5884

required to complete or file this form. Instead, they can

unless the credit is extended. See Future Developments,

report this credit directly on Form 3800.

earlier.

How To Claim the Credit

Empowerment zone designations are scheduled to

•

expire at the end of 2013. Wages paid or incurred for

You must request and be issued a certification for each

services performed after 2013 by a designated

employee from the state employment security agency

community resident or summer youth employee who lives

(SESA). The certification proves that the employee is a

in an empowerment zone may no longer qualify for the

member of a targeted group. You must receive the

work opportunity credit unless the designation is

certification by the day the individual begins work or

extended. See Qualified Wages for details.

complete Form 8850, Pre-Screening Notice and

Certification Request for the Work Opportunity Credit, on

or before the day you offer the individual a job.

5884

For Paperwork Reduction Act Notice, see instructions.

Form

(2013)

Cat. No. 13570D

1

1 2

2 3

3