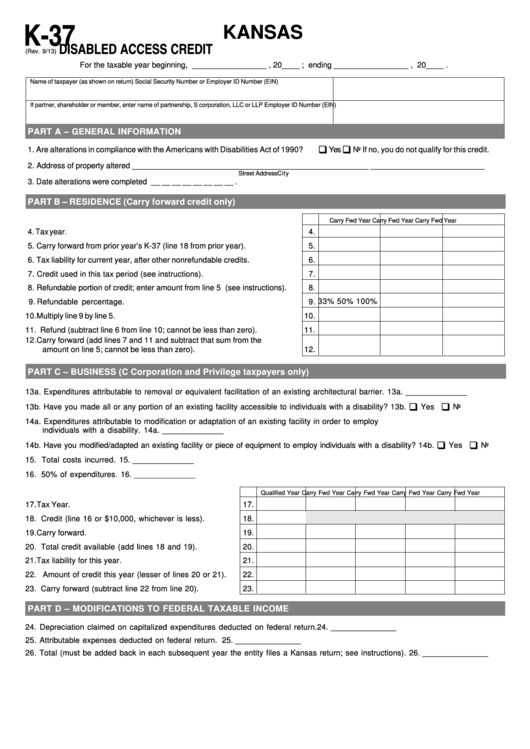

K-37

KANSAS

DISABLED ACCESS CREDIT

(Rev. 9/13)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – GENERAL INFORMATION

‰

‰

1. Are alterations in compliance with the Americans with Disabilities Act of 1990?

Yes

No If no, you do not qualify for this credit.

2. Address of property altered ______________________________________________________

__________________________

Street Address

City

3. Date alterations were completed __ __ __ __ __ __ __ __ .

PART B – RESIDENCE (Carry forward credit only)

Carry Fwd Year

Carry Fwd Year

Carry Fwd Year

4.

Tax year.

4.

5.

Carry forward from prior year’s K-37 (line 18 from prior year).

5.

6.

Tax liability for current year, after other nonrefundable credits.

6.

7.

Credit used in this tax period (see instructions).

7.

8.

Refundable portion of credit; enter amount from line 5 (see instructions).

8.

33%

50%

100%

9.

Refundable percentage.

9.

10. Multiply line 9 by line 5.

10.

11. Refund (subtract line 6 from line 10; cannot be less than zero).

11.

12. Carry forward (add lines 7 and 11 and subtract that sum from the

amount on line 5; cannot be less than zero).

12.

PART C – BUSINESS (C Corporation and Privilege taxpayers only)

13a. Expenditures attributable to removal or equivalent facilitation of an existing architectural barrier.

13a. ______________

‰

‰

13b. Have you made all or any portion of an existing facility accessible to individuals with a disability?

13b.

Yes

No

14a. Expenditures attributable to modification or adaptation of an existing facility in order to employ

individuals with a disability.

14a. ______________

‰

‰

14b. Have you modified/adapted an existing facility or piece of equipment to employ individuals with a disability?

14b.

Yes

No

15. Total costs incurred.

15. ______________

16. 50% of expenditures.

16. ______________

Qualified Year

Carry Fwd Year

Carry Fwd Year

Carry Fwd Year

Carry Fwd Year

17. Tax Year.

17.

18. Credit (line 16 or $10,000, whichever is less).

18.

19. Carry forward.

19.

20. Total credit available (add lines 18 and 19).

20.

21. Tax liability for this year.

21.

22. Amount of credit this year (lesser of lines 20 or 21).

22.

23. Carry forward (subtract line 22 from line 20).

23.

PART D – MODIFICATIONS TO FEDERAL TAXABLE INCOME

24. Depreciation claimed on capitalized expenditures deducted on federal return.

24. _______________

25. Attributable expenses deducted on federal return.

25. _______________

26. Total (must be added back in each subsequent year the entity files a Kansas return; see instructions).

26. _______________

1

1 2

2