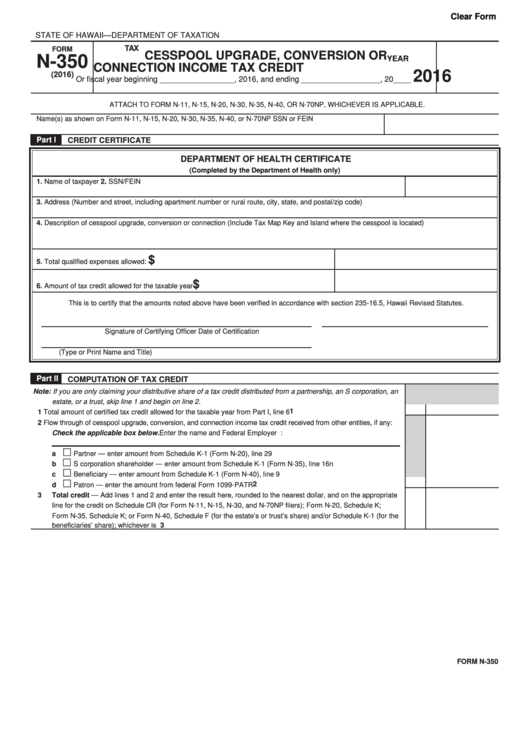

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX

FORM

CESSPOOL UPGRADE, CONVERSION OR

N-350

YEAR

CONNECTION INCOME TAX CREDIT

2016

(2016)

Or fiscal year beginning _________________, 2016, and ending __________________, 20____

ATTACH TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP, WHICHEVER IS APPLICABLE.

Name(s) as shown on Form N-11, N-15, N-20, N-30, N-35, N-40, or N-70NP

SSN or FEIN

Part I

CREDIT CERTIFICATE

DEPARTMENT OF HEALTH CERTIFICATE

(Completed by the Department of Health only)

1. Name of taxpayer

2. SSN/FEIN

3. Address (Number and street, including apartment number or rural route, city, state, and postal/zip code)

4. Description of cesspool upgrade, conversion or connection (Include Tax Map Key and Island where the cesspool is located)

$

5. Total qualified expenses allowed: .............................................................................................

$

6. Amount of tax credit allowed for the taxable year .....................................................................

This is to certify that the amounts noted above have been verified in accordance with section 235-16.5, Hawaii Revised Statutes.

Signature of Certifying Officer

Date of Certification

(Type or Print Name and Title)

Part II

COMPUTATION OF TAX CREDIT

Note: If you are only claiming your distributive share of a tax credit distributed from a partnership, an S corporation, an

estate, or a trust, skip line 1 and begin on line 2.

1

1

Total amount of certified tax credit allowed for the taxable year from Part I, line 6 ......................................................

2

Flow through of cesspool upgrade, conversion, and connection income tax credit received from other entities, if any:

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity:

a

Partner — enter amount from Schedule K-1 (Form N-20), line 29 ...................................................................

b

S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 16n ...................................

c

Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9 ...............................................................

2

d

Patron — enter the amount from federal Form 1099-PATR ..............................................................................

3

Total credit — Add lines 1 and 2 and enter the result here, rounded to the nearest dollar, and on the appropriate

line for the credit on Schedule CR (for Form N-11, N-15, N-30, and N-70NP filers); Form N-20, Schedule K;

Form N-35, Schedule K; or Form N-40, Schedule F (for the estate’s or trust’s share) and/or Schedule K-1 (for the

3

beneficiaries’ share); whichever is applicable...............................................................................................................

FORM N-350

1

1 2

2