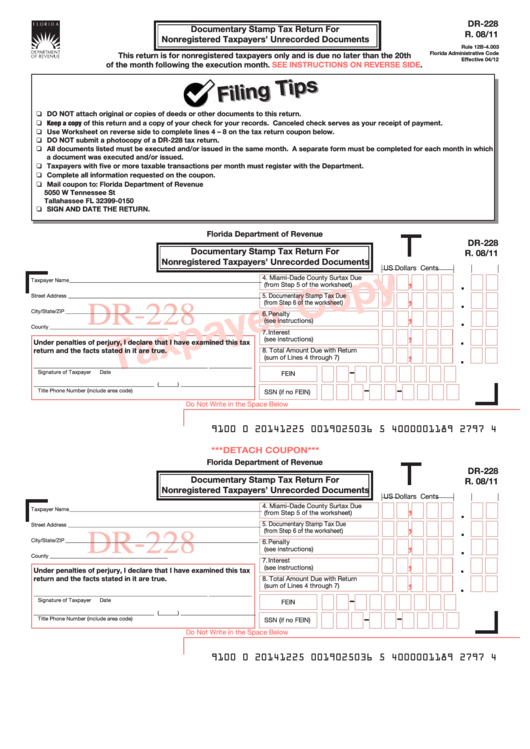

DR-228

Documentary Stamp Tax Return For

R. 08/11

Nonregistered Taxpayers’ Unrecorded Documents

Rule 12B-4.003

Florida Administrative Code

This return is for nonregistered taxpayers only and is due no later than the 20th

Effective 04/12

of the month following the execution month.

SEE INSTRUCTIONS ON REVERSE

SIDE.

o DO NOT attach original or copies of deeds or other documents to this return.

o Keep a copy of this return and a copy of your check for your records. Canceled check serves as your receipt of payment.

o Use Worksheet on reverse side to complete lines 4 – 8 on the tax return coupon below.

o DO NOT submit a photocopy of a DR-228 tax return.

o All documents listed must be executed and/or issued in the same month. A separate form must be completed for each month in which

a document was executed and/or issued.

o Taxpayers with five or more taxable transactions per month must register with the Department.

o Complete all information requested on the coupon.

o Mail coupon to:

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0150

o SIGN AND DATE THE RETURN.

Florida Department of Revenue

DR-228

Documentary Stamp Tax Return For

R. 08/11

Nonregistered Taxpayers’ Unrecorded Documents

US Dollars

Cents

,

4. Miami-Dade County Surtax Due

Taxpayer Name ________________________________________________________________________

(from Step 5 of the worksheet)

,

5. Documentary Stamp Tax Due

Street Address ________________________________________________________________________

(from Step 6 of the worksheet)

,

City/State/ZIP ________________________________________________________________________

6. Penalty

(see instructions)

,

County ____________________________________________

7. Interest

(see instructions)

Under penalties of perjury, I declare that I have examined this tax

,

return and the facts stated in it are true.

8. Total Amount Due with Return

(sum of Lines 4 through 7)

_________________________________________________________________ ________________

-

Signature of Taxpayer

Date

FEIN

-

-

_____________________________________________ (_______) ____________________________

Title

Phone Number (include area code)

SSN (if no FEIN)

Do Not Write in the Space Below

9100 0 20141225 0019025036 5 4000001189 2797 4

***DETACH COUPON***

Florida Department of Revenue

DR-228

Documentary Stamp Tax Return For

R. 08/11

Nonregistered Taxpayers’ Unrecorded Documents

US Dollars

Cents

,

4. Miami-Dade County Surtax Due

Taxpayer Name ________________________________________________________________________

(from Step 5 of the worksheet)

,

5. Documentary Stamp Tax Due

Street Address ________________________________________________________________________

(from Step 6 of the worksheet)

,

City/State/ZIP ________________________________________________________________________

6. Penalty

(see instructions)

,

County ____________________________________________

7. Interest

(see instructions)

Under penalties of perjury, I declare that I have examined this tax

,

return and the facts stated in it are true.

8. Total Amount Due with Return

(sum of Lines 4 through 7)

_________________________________________________________________ ________________

-

Signature of Taxpayer

Date

FEIN

-

_____________________________________________ (_______) ____________________________

-

Title

Phone Number (include area code)

SSN (if no FEIN)

Do Not Write in the Space Below

9100 0 20141225 0019025036 5 4000001189 2797 4

1

1 2

2