Form Pt-201 - Retailers Of Non-Highway Diesel Motor Fuel Only (Quarterly Filer)

ADVERTISEMENT

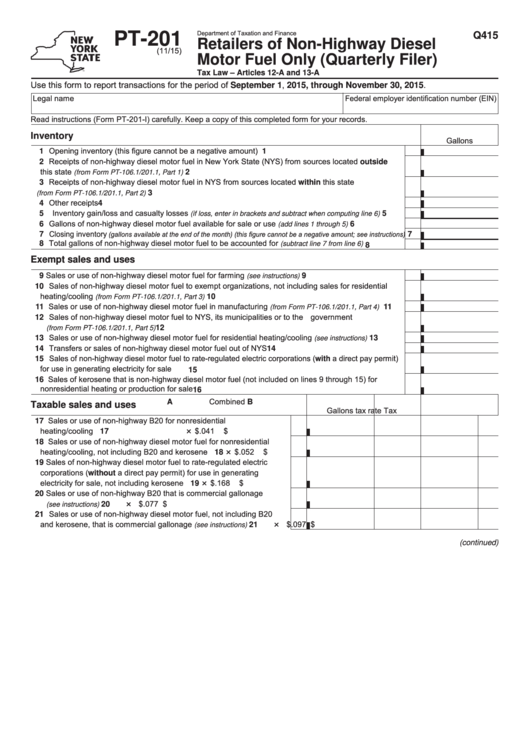

Department of Taxation and Finance

PT-201

Q415

Retailers of Non-Highway Diesel

(11/15)

Motor Fuel Only (Quarterly Filer)

Tax Law – Articles 12-A and 13-A

Use this form to report transactions for the period of September 1, 2015, through November 30, 2015.

Legal name

Federal employer identification number (EIN)

Read instructions (Form PT-201-I) carefully. Keep a copy of this completed form for your records.

Inventory

Gallons

1 Opening inventory (this figure cannot be a negative amount) ..................................................................

1

2 Receipts of non-highway diesel motor fuel in New York State (NYS) from sources located outside

this state

..............................................................................................

2

(from Form PT-106.1/201.1, Part 1)

3 Receipts of non-highway diesel motor fuel in NYS from sources located within this state

..............................................................................................................

3

(from Form PT-106.1/201.1, Part 2)

4 Other receipts.............................................................................................................................................

4

5 Inventory gain/loss and casualty losses

............

5

(if loss, enter in brackets and subtract when computing line 6)

6 Gallons of non-highway diesel motor fuel available for sale or use

..........................

6

(add lines 1 through 5)

7 Closing inventory

(gallons available at the end of the month) (this figure cannot be a negative amount; see instructions)

7

8 Total gallons of non-highway diesel motor fuel to be accounted for

...................

(subtract line 7 from line 6)

8

Exempt sales and uses

9 Sales or use of non-highway diesel motor fuel for farming

..............................................

9

(see instructions)

10 Sales of non-highway diesel motor fuel to exempt organizations, not including sales for residential

heating/cooling

.................................................................................... 10

(from Form PT-106.1/201.1, Part 3)

11 Sales or use of non-highway diesel motor fuel in manufacturing

........... 11

(from Form PT-106.1/201.1, Part 4)

12 Sales of non-highway diesel motor fuel to NYS, its municipalities or to the U.S. government

.............................................................................................................. 12

(from Form PT-106.1/201.1, Part 5)

13 Sales or use of non-highway diesel motor fuel for residential heating/cooling

................. 13

(see instructions)

14 Transfers or sales of non-highway diesel motor fuel out of NYS ............................................................... 14

15 Sales of non-highway diesel motor fuel to rate-regulated electric corporations (with a direct pay permit)

for use in generating electricity for sale ................................................................................................... 15

16 Sales of kerosene that is non-highway diesel motor fuel (not included on lines 9 through 15) for

nonresidential heating or production for sale.......................................................................................... 16

Combined

A

B

Taxable sales and uses

Gallons

tax rate

Tax

17 Sales or use of non-highway B20 for nonresidential

heating/cooling .................................................................................. 17

×

$.041 $

18 Sales or use of non-highway diesel motor fuel for nonresidential

heating/cooling, not including B20 and kerosene .............................. 18

$.052 $

×

19 Sales of non-highway diesel motor fuel to rate-regulated electric

corporations (without a direct pay permit) for use in generating

electricity for sale, not including kerosene ......................................... 19

$.168 $

×

20 Sales or use of non-highway B20 that is commercial gallonage

×

$.077 $

................................................................................. 20

(see instructions)

21 Sales or use of non-highway diesel motor fuel, not including B20

and kerosene, that is commercial gallonage

$.097 $

×

........... 21

(see instructions)

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2