Form Pt-104.1/202.1 - Kero-Jet Fuel Consumed In New York State By Aircraft

ADVERTISEMENT

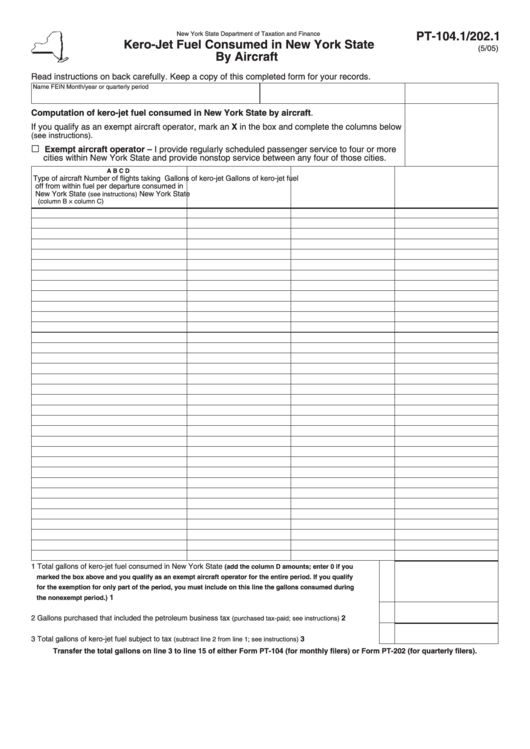

PT-104.1/202.1

New York State Department of Taxation and Finance

Kero-Jet Fuel Consumed in New York State

(5/05)

By Aircraft

Read instructions on back carefully. Keep a copy of this completed form for your records.

Name

FEIN

Month/year or quarterly period

Computation of kero-jet fuel consumed in New York State by aircraft.

If you qualify as an exempt aircraft operator, mark an X in the box and complete the columns below

.

(see instructions)

G

Exempt aircraft operator – I provide regularly scheduled passenger service to four or more

cities within New York State and provide nonstop service between any four of those cities.

A

B

C

D

Type of aircraft

Number of flights taking

Gallons of kero-jet

Gallons of kero-jet fuel

off from within

fuel per departure

consumed in

New York State

New York State

(see instructions)

(column B × column C)

1

Total gallons of kero-jet fuel consumed in New York State

(add the column D amounts; enter 0 if you

marked the box above and you qualify as an exempt aircraft operator for the entire period. If you qualify

for the exemption for only part of the period, you must include on this line the gallons consumed during

1

...........................................................................................................................

the nonexempt period.)

2

Gallons purchased that included the petroleum business tax

............

2

(purchased tax-paid; see instructions)

3

3

Total gallons of kero-jet fuel subject to tax

.................................

(subtract line 2 from line 1; see instructions)

Transfer the total gallons on line 3 to line 15 of either Form PT-104 (for monthly filers) or Form PT-202 (for quarterly filers).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2