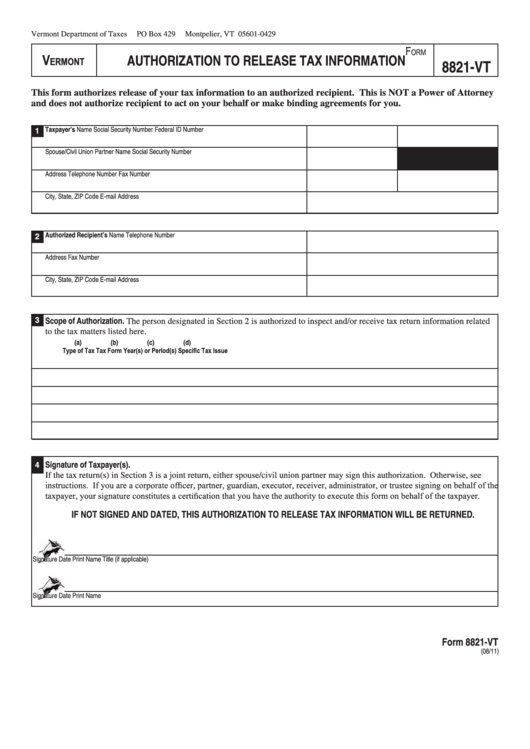

Form 8821-Vt - Authorization To Release Tax Information - 2011

ADVERTISEMENT

Vermont Department of Taxes

PO Box 429

Montpelier, VT 05601-0429

F

orm

V

AUTHORIZATION TO RELEASE TAX INFORMATION

ermont

8821-VT

This form authorizes release of your tax information to an authorized recipient. This is NOT a Power of Attorney

and does not authorize recipient to act on your behalf or make binding agreements for you.

Taxpayer’s Name

Social Security Number

Federal ID Number

1

Spouse/Civil Union Partner Name

Social Security Number

Address

Telephone Number

Fax Number

City, State, ZIP Code

E-mail Address

Authorized Recipient’s Name

Telephone Number

2

Address

Fax Number

City, State, ZIP Code

E-mail Address

Scope of Authorization. The person designated in Section 2 is authorized to inspect and/or receive tax return information related

3

to the tax matters listed here.

(a)

(b)

(c)

(d)

Type of Tax

Tax Form

Year(s) or Period(s)

Specific Tax Issue

Signature of Taxpayer(s).

4

If the tax return(s) in Section 3 is a joint return, either spouse/civil union partner may sign this authorization. Otherwise, see

instructions. If you are a corporate officer, partner, guardian, executor, receiver, administrator, or trustee signing on behalf of the

taxpayer, your signature constitutes a certification that you have the authority to execute this form on behalf of the taxpayer.

IF NOT SIGNED AND DATED, THIS AUTHORIZATION TO RELEASE TAX INFORMATION WILL BE RETURNED.

Signature

Date

Print Name

Title (if applicable)

Signature

Date

Print Name

Form 8821-VT

(08/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2