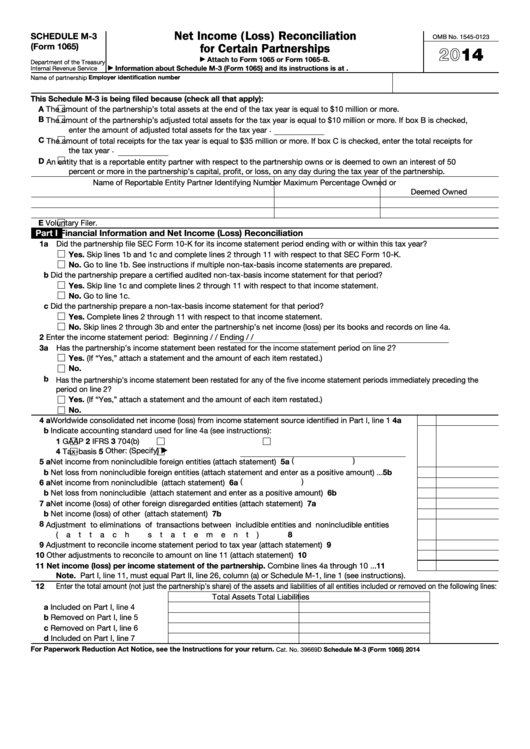

Net Income (Loss) Reconciliation

SCHEDULE M-3

OMB No. 1545-0123

for Certain Partnerships

(Form 1065)

2014

Attach to Form 1065 or Form 1065-B.

▶

Department of the Treasury

Information about Schedule M-3 (Form 1065) and its instructions is at

Internal Revenue Service

▶

Employer identification number

Name of partnership

This Schedule M-3 is being filed because (check all that apply):

A

The amount of the partnership’s total assets at the end of the tax year is equal to $10 million or more.

B

The amount of the partnership’s adjusted total assets for the tax year is equal to $10 million or more. If box B is checked,

.

enter the amount of adjusted total assets for the tax year

C

The amount of total receipts for the tax year is equal to $35 million or more. If box C is checked, enter the total receipts for

.

the tax year

D

An entity that is a reportable entity partner with respect to the partnership owns or is deemed to own an interest of 50

percent or more in the partnership’s capital, profit, or loss, on any day during the tax year of the partnership.

Name of Reportable Entity Partner

Identifying Number

Maximum Percentage Owned or

Deemed Owned

E

Voluntary Filer.

Part I

Financial Information and Net Income (Loss) Reconciliation

1a Did the partnership file SEC Form 10-K for its income statement period ending with or within this tax year?

Yes. Skip lines 1b and 1c and complete lines 2 through 11 with respect to that SEC Form 10-K.

No. Go to line 1b. See instructions if multiple non-tax-basis income statements are prepared.

b Did the partnership prepare a certified audited non-tax-basis income statement for that period?

Yes. Skip line 1c and complete lines 2 through 11 with respect to that income statement.

No. Go to line 1c.

c Did the partnership prepare a non-tax-basis income statement for that period?

Yes. Complete lines 2 through 11 with respect to that income statement.

No. Skip lines 2 through 3b and enter the partnership’s net income (loss) per its books and records on line 4a.

2

Enter the income statement period: Beginning

/

/

Ending

/

/

3a Has the partnership’s income statement been restated for the income statement period on line 2?

Yes. (If “Yes,” attach a statement and the amount of each item restated.)

No.

b Has the partnership’s income statement been restated for any of the five income statement periods immediately preceding the

period on line 2?

Yes. (If “Yes,” attach a statement and the amount of each item restated.)

No.

4 a Worldwide consolidated net income (loss) from income statement source identified in Part I, line 1

4a

b Indicate accounting standard used for line 4a (see instructions):

1

GAAP

2

IFRS

3

704(b)

Other: (Specify)

4

Tax-basis

5

▶

5a (

)

5 a Net income from nonincludible foreign entities (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

b Net loss from nonincludible foreign entities (attach statement and enter as a positive amount) .

.

.

5b

6a (

)

6 a Net income from nonincludible U.S. entities (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

.

b Net loss from nonincludible U.S. entities (attach statement and enter as a positive amount) .

6b

.

.

.

7 a Net income (loss) of other foreign disregarded entities (attach statement) .

.

.

.

.

.

.

.

.

.

7a

b Net income (loss) of other U.S. disregarded entities (attach statement) .

.

.

.

.

.

.

.

.

.

.

7b

8

Adjustment to eliminations of transactions between includible entities and nonincludible entities

8

(attach statement) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Adjustment to reconcile income statement period to tax year (attach statement)

.

.

.

.

.

.

.

9

10

Other adjustments to reconcile to amount on line 11 (attach statement)

.

.

.

.

.

.

.

.

.

.

10

11

Net income (loss) per income statement of the partnership. Combine lines 4a through 10 .

11

.

.

Note. Part I, line 11, must equal Part II, line 26, column (a) or Schedule M-1, line 1 (see instructions).

12

Enter the total amount (not just the partnership’s share) of the assets and liabilities of all entities included or removed on the following lines:

Total Assets

Total Liabilities

a Included on Part I, line 4

b Removed on Part I, line 5

c Removed on Part I, line 6

d Included on Part I, line 7

For Paperwork Reduction Act Notice, see the Instructions for your return.

Schedule M-3 (Form 1065) 2014

Cat. No. 39669D

1

1 2

2 3

3