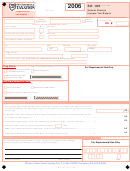

SD 100X

Rev. 6/12

SD 100X Instructions for Years 2008 and Forward

Note: Be sure to complete and attach the "Reason and Explanation of Corrections" on page 2.

2. If your school district amended return shows a refund on account

General Information

of a decrease in your federal adjusted gross income and if the IRS

1. Use Ohio form SD 100X for the following:

issues you a refund check due to that decrease, you always have

correct your school district tax return; AND/OR

at least 60 days from the date the IRS agreed to the decrease to

fi le your Ohio and school district amended income tax returns.

request a refund of tax, interest and/or penalty previously paid;

AND/OR

Your amended return may not be processed until after Oct. 15.

report IRS changes that affected the number of exemptions

Change in Filing Status

claimed; AND/OR

You can change your fi ling status from married fi ling separately

to married fi ling jointly anytime within the statute of limitations,

report IRS changes that affected your federal adjusted gross

but without taking into consideration any extension of time to fi le.

income; AND/OR

However, you only have until the date the Ohio school district tax

return was due, without extensions, to change your fi ling status from

change your fi ling status (see Change in Filing Status at

married fi ling jointly to married fi ling separately. In any event, your

right).

fi ling status for school district income tax purposes must be

2. You can fi le Ohio school district form SD 100X only after you

the same as your fi ling status for IRS purposes.

have fi led an Ohio school district income tax return (Ohio form

SD 100 or any of the department’s paperless or electronic tax

General Instructions

return fi ling options).

A. Enter the school district number from your original return.

3. You must complete all of the information requested on the front

B. To calculate the amounts you will show in the "as amended"

of the form. Otherwise, we cannot process your amended return,

column, use the school district income tax instruction booklet for

and we will return it to you.

the return year you are amending.

4. If your amended school district income tax return shows a refund

Line Instructions

due on account of either (a) a change in your federal adjusted

Line 2 – See the school district income tax instruction booklet for

gross income or (b) a change in your fi ling status from married

the return year you are amending.

fi ling jointly to married fi ling separately, you can speed up the

refund process if you do the following:

Line 9 – You must attach W-2s to the back of this form only if the

amount shown on line 9 as amended is greater than the withholding

(1) Attach a copy of your amended federal income tax return

amount you reported on your originally fi led return.

(IRS form 1040X) and

Line 13 – Enter on this line all of the following:

(2) Attach either a copy of the federal refund check or a copy of

the IRS acceptance letter.

Refunds you claimed on previously fi led returns for the year

and school district number shown on the front of this form –

If you are unable to attach this information, we will require several

even if you have not yet received the refund.

extra weeks to process your refund.

Amounts you claimed as an overpayment credit to the following

5. If you fi le your return after the unextended due date and if you

year (for the exception, see "Special Rule" below).

paid and/or will pay any tax after the unextended due date, you

owe interest.

Special Rule

If you want to reduce the amount of your overpayment credit shown

Penalty may be due on late-fi led returns and/or late-paid tax.

on the originally fi led return for the year, you must do both of the

Please see a discussion of interest and penalty in the individual

following:

income tax return instructions for the year for which you’re fi l-

ing.

Include on line 13 only the amount of the overpayment credit

that you claimed on your originally fi led return and that you

Time Period in Which to File (Statute of Limitations)

now want applied to the next year; AND

1. Generally, you can claim a refund within four years from the date

of the overpayment of the tax. For most taxpayers, the four-year

Amend next year's return (if already fi led) to show the reduction

period begins on the date the school district income tax return

in the amount of the overpayment credit you want to apply to

was due (without extensions). For example, the 2009 Ohio form

the next year.

SD 100 is due on April 15, 2010.

- 3 -

1

1 2

2 3

3