Form Dp-145-Es - Estimated Legacy & Succession Tax

ADVERTISEMENT

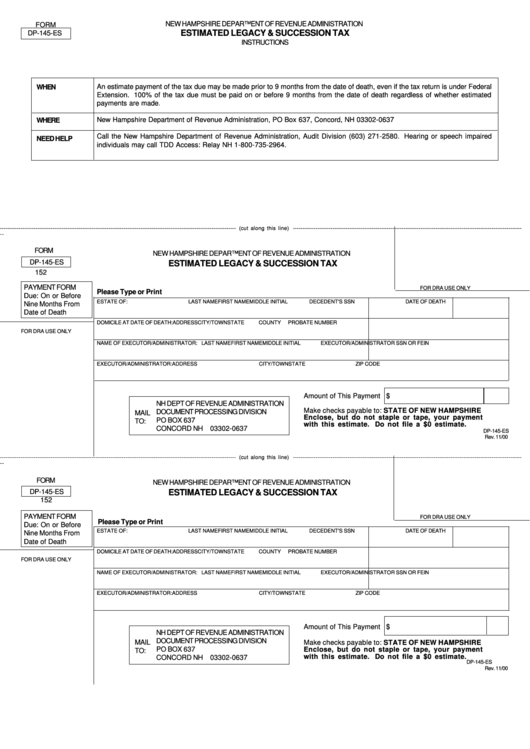

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

ESTIMATED LEGACY & SUCCESSION TAX

DP-145-ES

INSTRUCTIONS

An estimate payment of the tax due may be made prior to 9 months from the date of death, even if the tax return is under Federal

WHEN

Extension. 100% of the tax due must be paid on or before 9 months from the date of death regardless of whether estimated

payments are made.

New Hampshire Department of Revenue Administration, PO Box 637, Concord, NH 03302-0637

WHERE

Call the New Hampshire Department of Revenue Administration, Audit Division (603) 271-2580. Hearing or speech impaired

NEED HELP

individuals may call TDD Access: Relay NH 1-800-735-2964.

------------------------------------------------------------------------------------------------------------------------------ (cut along this line) --------------------------------------------------------------------------------------------------------------------------

--

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-145-ES

ESTIMATED LEGACY & SUCCESSION TAX

152

PAYMENT FORM

FOR DRA USE ONLY

Please Type or Print

Due: On or Before

ESTATE OF:

LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEDENT'S SSN

DATE OF DEATH

Nine Months From

Date of Death

DOMICILE AT DATE OF DEATH:

ADDRESS

CITY/TOWN

STATE

COUNTY

PROBATE NUMBER

FOR DRA USE ONLY

NAME OF EXECUTOR/ADMINISTRATOR: LAST NAME

FIRST NAME

MIDDLE INITIAL

EXECUTOR/ADMINISTRATOR SSN OR FEIN

EXECUTOR/ADMINISTRATOR:

ADDRESS

CITY/TOWN

STATE

ZIP CODE

Amount of This Payment $

NH DEPT OF REVENUE ADMINISTRATION

Make checks payable to: STATE OF NEW HAMPSHIRE

DOCUMENT PROCESSING DIVISION

MAIL

Enclose, but do not staple or tape, your payment

PO BOX 637

TO:

with this estimate. Do not file a $0 estimate.

CONCORD NH 03302-0637

DP-145-ES

Rev. 11/00

------------------------------------------------------------------------------------------------------------------------------ (cut along this line) --------------------------------------------------------------------------------------------------------------------------

--

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-145-ES

ESTIMATED LEGACY & SUCCESSION TAX

152

PAYMENT FORM

FOR DRA USE ONLY

Please Type or Print

Due: On or Before

ESTATE OF:

LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEDENT'S SSN

DATE OF DEATH

Nine Months From

Date of Death

DOMICILE AT DATE OF DEATH:

ADDRESS

CITY/TOWN

STATE

COUNTY

PROBATE NUMBER

FOR DRA USE ONLY

NAME OF EXECUTOR/ADMINISTRATOR: LAST NAME

FIRST NAME

MIDDLE INITIAL

EXECUTOR/ADMINISTRATOR SSN OR FEIN

EXECUTOR/ADMINISTRATOR:

ADDRESS

CITY/TOWN

STATE

ZIP CODE

Amount of This Payment $

NH DEPT OF REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

MAIL

Make checks payable to: STATE OF NEW HAMPSHIRE

PO BOX 637

Enclose, but do not staple or tape, your payment

TO:

with this estimate. Do not file a $0 estimate.

CONCORD NH 03302-0637

DP-145-ES

Rev. 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1