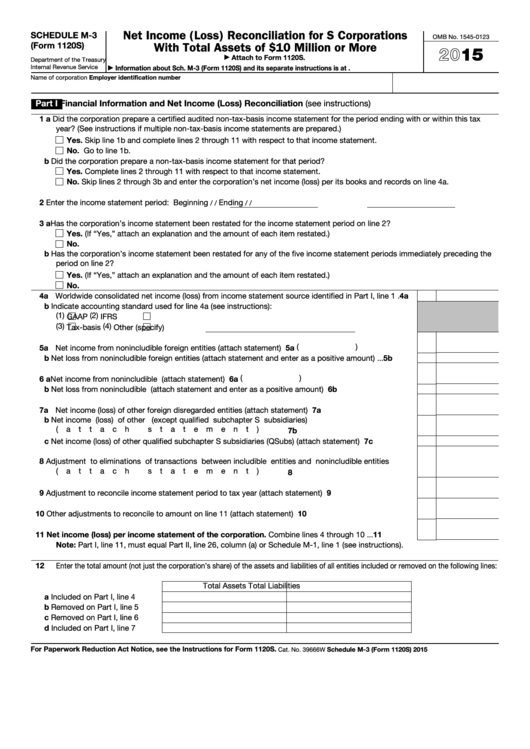

Net Income (Loss) Reconciliation for S Corporations

SCHEDULE M-3

OMB No. 1545-0123

(Form 1120S)

With Total Assets of $10 Million or More

2015

Attach to Form 1120S.

▶

Department of the Treasury

Internal Revenue Service

Information about Sch. M-3 (Form 1120S) and its separate instructions is at

▶

Employer identification number

Name of corporation

Part I

Financial Information and Net Income (Loss) Reconciliation (see instructions)

1 a Did the corporation prepare a certified audited non-tax-basis income statement for the period ending with or within this tax

year? (See instructions if multiple non-tax-basis income statements are prepared.)

Yes. Skip line 1b and complete lines 2 through 11 with respect to that income statement.

No. Go to line 1b.

b Did the corporation prepare a non-tax-basis income statement for that period?

Yes. Complete lines 2 through 11 with respect to that income statement.

No. Skip lines 2 through 3b and enter the corporation’s net income (loss) per its books and records on line 4a.

2

Enter the income statement period: Beginning

Ending

/

/

/

/

3 a Has the corporation’s income statement been restated for the income statement period on line 2?

Yes. (If “Yes,” attach an explanation and the amount of each item restated.)

No.

b Has the corporation’s income statement been restated for any of the five income statement periods immediately preceding the

period on line 2?

Yes. (If “Yes,” attach an explanation and the amount of each item restated.)

No.

4 a Worldwide consolidated net income (loss) from income statement source identified in Part I, line 1

.

4a

b Indicate accounting standard used for line 4a (see instructions):

(1)

(2)

GAAP

IFRS

(3)

(4)

Tax-basis

Other (specify)

5a (

)

5 a Net income from nonincludible foreign entities (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

b Net loss from nonincludible foreign entities (attach statement and enter as a positive amount) .

5b

.

.

6a (

)

6 a Net income from nonincludible U.S. entities (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

.

b Net loss from nonincludible U.S. entities (attach statement and enter as a positive amount) .

6b

.

.

.

7 a Net income (loss) of other foreign disregarded entities (attach statement) .

.

.

.

.

.

.

.

.

.

7a

b Net income (loss) of other U.S. disregarded entities (except qualified subchapter S subsidiaries)

(attach statement) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7b

c Net income (loss) of other qualified subchapter S subsidiaries (QSubs) (attach statement)

.

.

.

.

7c

8

Adjustment to eliminations of transactions between includible entities and nonincludible entities

(attach statement) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

9

Adjustment to reconcile income statement period to tax year (attach statement)

.

.

.

.

.

.

.

10

Other adjustments to reconcile to amount on line 11 (attach statement)

.

.

.

.

.

.

.

.

.

.

10

11

Net income (loss) per income statement of the corporation. Combine lines 4 through 10

11

.

.

.

Note: Part I, line 11, must equal Part II, line 26, column (a) or Schedule M-1, line 1 (see instructions).

12

Enter the total amount (not just the corporation’s share) of the assets and liabilities of all entities included or removed on the following lines:

Total Assets

Total Liabilities

a Included on Part I, line 4

b Removed on Part I, line 5

c Removed on Part I, line 6

d Included on Part I, line 7

For Paperwork Reduction Act Notice, see the Instructions for Form 1120S.

Schedule M-3 (Form 1120S) 2015

Cat. No. 39666W

1

1 2

2 3

3