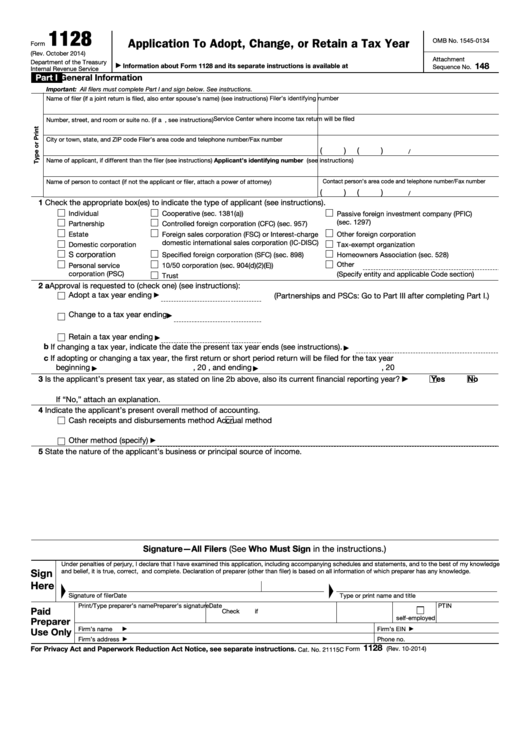

1128

Application To Adopt, Change, or Retain a Tax Year

OMB No. 1545-0134

Form

(Rev. October 2014)

Attachment

Department of the Treasury

148

Information about Form 1128 and its separate instructions is available at

Sequence No.

Internal Revenue Service

Part I

General Information

Important: All filers must complete Part I and sign below. See instructions.

Filer’s identifying number

Name of filer (if a joint return is filed, also enter spouse’s name) (see instructions)

Service Center where income tax return will be filed

Number, street, and room or suite no. (if a P.O. box, see instructions)

City or town, state, and ZIP code

Filer’s area code and telephone number/Fax number

(

)

(

)

/

Name of applicant, if different than the filer (see instructions)

Applicant’s identifying number (see instructions)

Contact person’s area code and telephone number/Fax number

Name of person to contact (if not the applicant or filer, attach a power of attorney)

(

)

(

)

/

1

Check the appropriate box(es) to indicate the type of applicant (see instructions).

Individual

Cooperative (sec. 1381(a))

Passive foreign investment company (PFIC)

(sec. 1297)

Partnership

Controlled foreign corporation (CFC) (sec. 957)

Estate

Other foreign corporation

Foreign sales corporation (FSC) or Interest-charge

domestic international sales corporation (IC-DISC)

Domestic corporation

Tax-exempt organization

S corporation

Specified foreign corporation (SFC) (sec. 898)

Homeowners Association (sec. 528)

Other

Personal service

10/50 corporation (sec. 904(d)(2)(E))

corporation (PSC)

(Specify entity and applicable Code section)

Trust

2 a Approval is requested to (check one) (see instructions):

Adopt a tax year ending

(Partnerships and PSCs: Go to Part III after completing Part I.)

▶

Change to a tax year ending

▶

Retain a tax year ending

▶

b If changing a tax year, indicate the date the present tax year ends (see instructions).

▶

c If adopting or changing a tax year, the first return or short period return will be filed for the tax year

beginning

, 20

, and ending

, 20

▶

▶

3

Is the applicant’s present tax year, as stated on line 2b above, also its current financial reporting year?

Yes

No

▶

If “No,” attach an explanation.

4

Indicate the applicant’s present overall method of accounting.

Cash receipts and disbursements method

Accrual method

Other method (specify)

▶

5

State the nature of the applicant’s business or principal source of income.

Signature—All Filers (See Who Must Sign in the instructions.)

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my knowledge

Sign

and belief, it is true, correct, and complete. Declaration of preparer (other than filer) is based on all information of which preparer has any knowledge.

Here

Signature of filer

Date

Type or print name and title

Print/Type preparer’s name

Preparer’s signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm’s EIN

Use Only

▶

▶

Firm’s address

Phone no.

▶

1128

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 10-2014)

Cat. No. 21115C

1

1 2

2 3

3 4

4