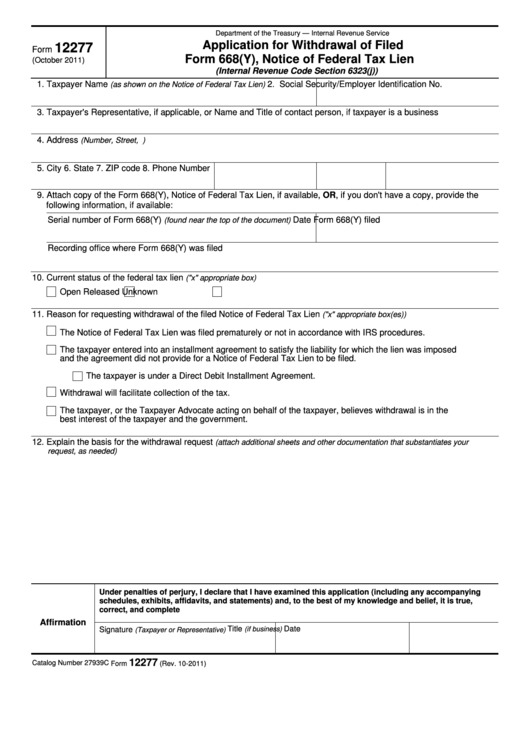

Department of the Treasury — Internal Revenue Service

Application for Withdrawal of Filed

12277

Form

Form 668(Y), Notice of Federal Tax Lien

(October 2011)

(Internal Revenue Code Section 6323(j))

1. Taxpayer Name

2. Social Security/Employer Identification No.

(as shown on the Notice of Federal Tax Lien)

3. Taxpayer's Representative, if applicable, or Name and Title of contact person, if taxpayer is a business

4. Address

(Number, Street, P.O. Box)

5. City

6. State

7. ZIP code

8. Phone Number

9. Attach copy of the Form 668(Y), Notice of Federal Tax Lien, if available, OR, if you don't have a copy, provide the

following information, if available:

Serial number of Form 668(Y)

Date Form 668(Y) filed

(found near the top of the document)

Recording office where Form 668(Y) was filed

10. Current status of the federal tax lien

("x" appropriate box)

Open

Released

Unknown

11. Reason for requesting withdrawal of the filed Notice of Federal Tax Lien

("x" appropriate box(es))

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The taxpayer entered into an installment agreement to satisfy the liability for which the lien was imposed

and the agreement did not provide for a Notice of Federal Tax Lien to be filed.

The taxpayer is under a Direct Debit Installment Agreement.

Withdrawal will facilitate collection of the tax.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the

best interest of the taxpayer and the government.

12. Explain the basis for the withdrawal request

(attach additional sheets and other documentation that substantiates your

request, as needed)

Under penalties of perjury, I declare that I have examined this application (including any accompanying

schedules, exhibits, affidavits, and statements) and, to the best of my knowledge and belief, it is true,

correct, and complete

Affirmation

Title

Date

(if business)

Signature

(Taxpayer or Representative)

12277

Catalog Number 27939C

Form

(Rev. 10-2011)

1

1 2

2