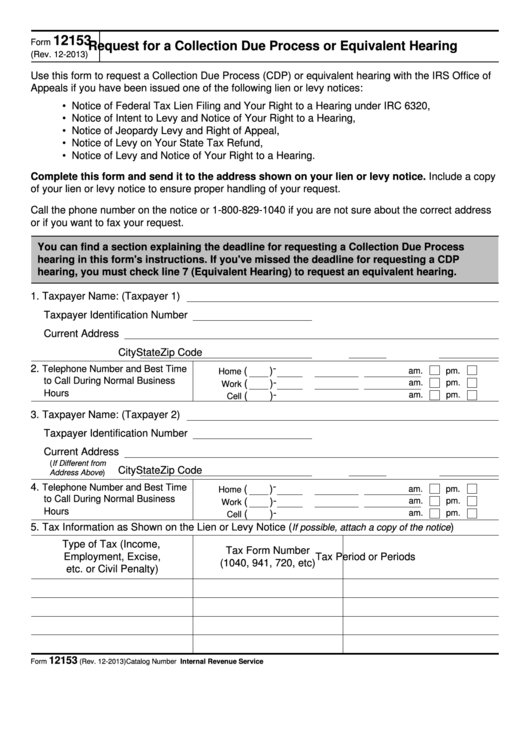

12153

Form

Request for a Collection Due Process or Equivalent Hearing

(Rev. 12-2013)

Use this form to request a Collection Due Process (CDP) or equivalent hearing with the IRS Office of

Appeals if you have been issued one of the following lien or levy notices:

• Notice of Federal Tax Lien Filing and Your Right to a Hearing under IRC 6320,

• Notice of Intent to Levy and Notice of Your Right to a Hearing,

• Notice of Jeopardy Levy and Right of Appeal,

• Notice of Levy on Your State Tax Refund,

• Notice of Levy and Notice of Your Right to a Hearing.

Complete this form and send it to the address shown on your lien or levy notice. Include a copy

of your lien or levy notice to ensure proper handling of your request.

Call the phone number on the notice or 1-800-829-1040 if you are not sure about the correct address

or if you want to fax your request.

You can find a section explaining the deadline for requesting a Collection Due Process

hearing in this form's instructions. If you've missed the deadline for requesting a CDP

hearing, you must check line 7 (Equivalent Hearing) to request an equivalent hearing.

1. Taxpayer Name: (Taxpayer 1)

Taxpayer Identification Number

Current Address

City

State

Zip Code

-

2.

Telephone Number and Best Time

(

)

am.

pm.

Home

to Call During Normal Business

-

(

)

am.

pm.

Work

Hours

-

am.

pm.

(

)

Cell

3. Taxpayer Name: (Taxpayer 2)

Taxpayer Identification Number

Current Address

(If Different from

City

State

Zip Code

Address Above)

-

4.

Telephone Number and Best Time

(

)

am.

pm.

Home

to Call During Normal Business

-

(

)

am.

pm.

Work

Hours

-

am.

pm.

(

)

Cell

5. Tax Information as Shown on the Lien or Levy Notice (

)

If possible, attach a copy of the notice

Type of Tax (Income,

Tax Form Number

Employment, Excise,

Tax Period or Periods

(1040, 941, 720, etc)

etc. or Civil Penalty)

12153

Form

(Rev. 12-2013)

Catalog Number 26685D

Department of the Treasury - Internal Revenue Service

1

1 2

2 3

3 4

4