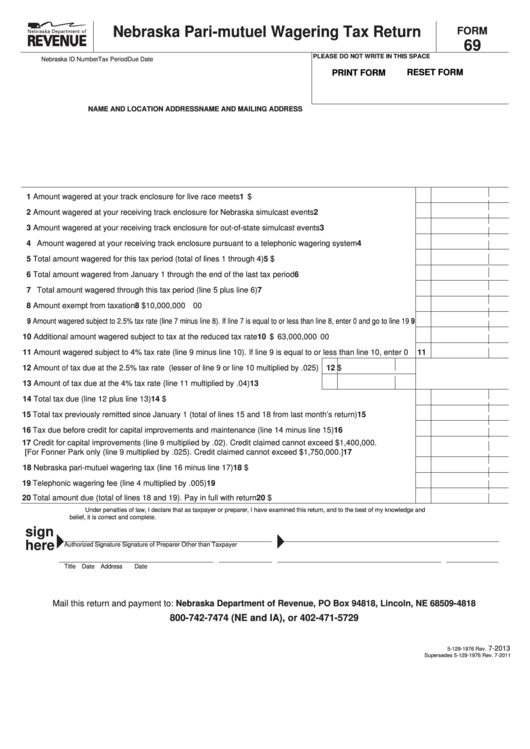

Nebraska Pari-mutuel Wagering Tax Return

FORM

69

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska ID Number

Tax Period

Due Date

RESET FORM

PRINT FORM

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

1 Amount wagered at your track enclosure for live race meets .............................................................................

1 $

2 Amount wagered at your receiving track enclosure for Nebraska simulcast events ...........................................

2

3 Amount wagered at your receiving track enclosure for out-of-state simulcast events ........................................

3

4 Amount wagered at your receiving track enclosure pursuant to a telephonic wagering system ........................

4

5 Total amount wagered for this tax period (total of lines 1 through 4) ..................................................................

5 $

6 Total amount wagered from January 1 through the end of the last tax period ...................................................

6

7 Total amount wagered through this tax period (line 5 plus line 6) ......................................................................

7

8 Amount exempt from taxation .............................................................................................................................

8 $

10,000,000 00

9 Amount wagered subject to 2.5% tax rate (line 7 minus line 8). If line 7 is equal to or less than line 8, enter 0 and go to line 19

9

10 Additional amount wagered subject to tax at the reduced tax rate .....................................................................

10 $

63,000,000 00

11 Amount wagered subject to 4% tax rate (line 9 minus line 10). If line 9 is equal to or less than line 10, enter 0

11

12 Amount of tax due at the 2.5% tax rate (lesser of line 9 or line 10 multiplied by .025)

12 $

13 Amount of tax due at the 4% tax rate (line 11 multiplied by .04) .............................

13

14 Total tax due (line 12 plus line 13) ......................................................................................................................

14 $

15 Total tax previously remitted since January 1 (total of lines 15 and 18 from last month’s return) ......................

15

16 Tax due before credit for capital improvements and maintenance (line 14 minus line 15) .................................

16

17 Credit for capital improvements (line 9 multiplied by .02). Credit claimed cannot exceed $1,400,000.

[For Fonner Park only (line 9 multiplied by .025). Credit claimed cannot exceed $1,750,000.] ..........................

17

18 Nebraska pari-mutuel wagering tax (line 16 minus line 17) ...............................................................................

18 $

19 Telephonic wagering fee (line 4 multiplied by .005) ............................................................................................

19

20 Total amount due (total of lines 18 and 19). Pay in full with return .....................................................................

20 $

Under penalties of law, I declare that as taxpayer or preparer, I have examined this return, and to the best of my knowledge and

belief, it is correct and complete.

sign

here

Authorized Signature

Signature of Preparer Other than Taxpayer

Title

Date

Address

Date

Mail this return and payment to: Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818

800-742-7474 (NE and IA), or 402-471-5729

7-2013

5-129-1976 Rev.

Supersedes 5-129-1976 Rev. 7-2011

1

1 2

2