Form Pt-100-B - Schedule Of Weekly Refund/reimbursement

ADVERTISEMENT

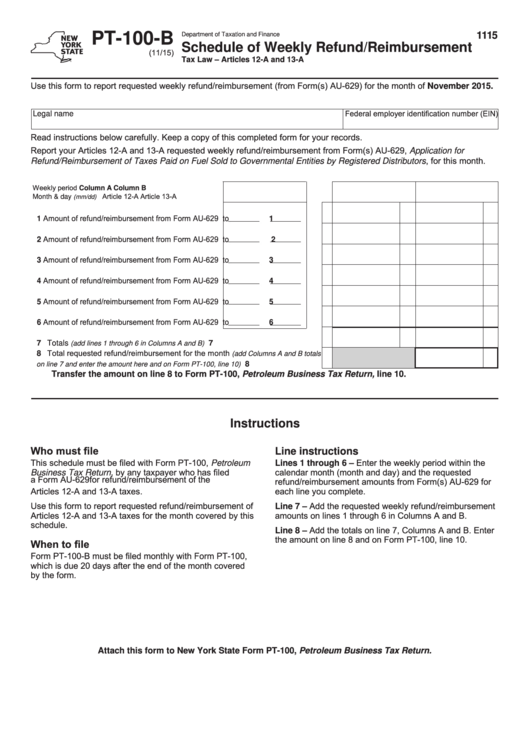

PT-100-B

1115

Department of Taxation and Finance

Schedule of Weekly Refund/Reimbursement

(11/15)

Tax Law – Articles 12-A and 13-A

Use this form to report requested weekly refund/reimbursement (from Form(s) AU-629) for the month of November 2015.

Federal employer identification number (EIN)

Legal name

Read instructions below carefully. Keep a copy of this completed form for your records.

Report your Articles 12-A and 13-A requested weekly refund/reimbursement from Form(s) AU-629, Application for

Refund/Reimbursement of Taxes Paid on Fuel Sold to Governmental Entities by Registered Distributors, for this month.

Weekly period

Column A

Column B

Article 12-A

Article 13-A

Month & day

(mm/dd)

1 Amount of refund/reimbursement from Form AU-629

..... 1

to

2 Amount of refund/reimbursement from Form AU-629

..... 2

to

3 Amount of refund/reimbursement from Form AU-629

..... 3

to

4 Amount of refund/reimbursement from Form AU-629

..... 4

to

5 Amount of refund/reimbursement from Form AU-629

..... 5

to

6 Amount of refund/reimbursement from Form AU-629

..... 6

to

...................................................... 7

7 Totals

(add lines 1 through 6 in Columns A and B)

8 Total requested refund/reimbursement for the month

(add Columns A and B totals

............................. 8

on line 7 and enter the amount here and on Form PT‑100, line 10)

Transfer the amount on line 8 to Form PT-100, Petroleum Business Tax Return, line 10.

Instructions

Who must file

Line instructions

This schedule must be filed with Form PT-100, Petroleum

Lines 1 through 6 – Enter the weekly period within the

Business Tax Return, by any taxpayer who has filed

calendar month (month and day) and the requested

a Form AU-629 for refund/reimbursement of the

refund/reimbursement amounts from Form(s) AU-629 for

Articles 12-A and 13-A taxes.

each line you complete.

Use this form to report requested refund/reimbursement of

Line 7 – Add the requested weekly refund/reimbursement

Articles 12-A and 13-A taxes for the month covered by this

amounts on lines 1 through 6 in Columns A and B.

schedule.

Line 8 – Add the totals on line 7, Columns A and B. Enter

the amount on line 8 and on Form PT-100, line 10.

When to file

Form PT-100-B must be filed monthly with Form PT-100,

which is due 20 days after the end of the month covered

by the form.

Attach this form to New York State Form PT-100, Petroleum Business Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1