Filing Assistance Program

OMB No. 1545-1316

9452

Form

(Do you have to file a Federal Income Tax Return?)

Department of the Treasury

See instructions on back.

Do not send to IRS.

Keep for your records.

Internal Revenue Service

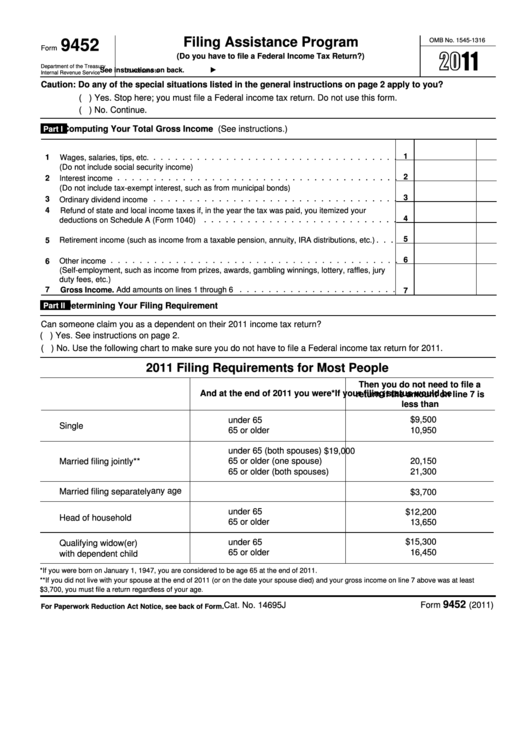

Caution: Do any of the special situations listed in the general instructions on page 2 apply to you?

( ) Yes. Stop here; you must file a Federal income tax return. Do not use this form.

( ) No. Continue.

Computing Your Total Gross Income (See instructions.)

Part I

1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Wages, salaries, tips, etc.

(Do not include social security income)

2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Interest income

(Do not include tax-exempt interest, such as from municipal bonds)

3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Ordinary dividend income

4

Refund of state and local income taxes if, in the year the tax was paid, you itemized your

4

. . . . . . . . . . . . . . . . . . . . . . . . . . .

deductions on Schedule A (Form 1040)

5

. . .

Retirement income (such as income from a taxable pension, annuity, IRA distributions, etc.)

5

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Other income

6

(Self-employment, such as income from prizes, awards, gambling winnings, lottery, raffles, jury

duty fees, etc.)

. . . . . . . . . . . . . . . . . . . . . .

7

Gross Income. Add amounts on lines 1 through 6

7

Part II

Determining Your Filing Requirement

Can someone claim you as a dependent on their 2011 income tax return?

( ) Yes. See instructions on page 2.

( ) No. Use the following chart to make sure you do not have to file a Federal income tax return for 2011.

2011 Filing Requirements for Most People

Then you do not need to file a

If your filing status would be

And at the end of 2011 you were*

return if the amount on line 7 is

less than

$9,500

under 65

Single

65 or older

10,950

under 65 (both spouses)

$19,000

65 or older (one spouse)

20,150

Married filing jointly**

65 or older (both spouses)

21,300

any age

Married filing separately

$3,700

under 65

$12,200

Head of household

65 or older

13,650

under 65

$15,300

Qualifying widow(er)

65 or older

16,450

with dependent child

*If you were born on January 1, 1947, you are considered to be age 65 at the end of 2011.

**If you did not live with your spouse at the end of 2011 (or on the date your spouse died) and your gross income on line 7 above was at least

$3,700, you must file a return regardless of your age.

9452

Cat. No. 14695J

Form

(2011)

For Paperwork Reduction Act Notice, see back of Form.

1

1 2

2