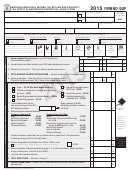

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 14

ADVERTISEMENT

Individual Income Tax Online Services

What is Georgia Tax Center?

Georgia Tax Center (GTC) is the Department of Revenue’s secure self-service

customer facing portal for making online Individual or Business Tax payments

and corresponding to the Department of Revenue.

Who Can Sign Up?

Any Individual that has filed an Individual Income Tax return or would like to submit an estimate payment

in the state of Georgia is eligible to use GTC.

GTC Features

You will be able to do the following without a GTC login:

•

Check refund status

Quick payments (Estimated return or assessment payments)

•

Protest a liability

•

Request penalty waivers

•

•

Submit additional documentation

A login is required to do the following:

Installment Plan Agreement (IPA)

•

•

Request Offer in Compromise (OIC)

Submit Power of Attorney (POA)

•

Request to view my 1099-G electronically in GTC

•

View account balance

•

•

Make payments

General account maintenance - address change

•

•

Receive notification when a return is filed using my SSN

Please visit our website for instructions:

DEPARTMENT OF REVENUE WEBSITE:

Visit our website to download tax forms, view a list of the mailing addresses for commonly used forms, and obtain answers

to Frequently Asked Questions. You may also order forms by submitting an e-mail to taxforms@dor.ga.gov.

Senior citizens may call AARP Tax-Aide toll-free at 1-888-AARPNOW (1-888-227-7669) from February 1 to April 18 for

assistance with filing both Federal and Georgia income tax forms.

If you have a disability and need additional assistance, please contact one of the Revenue Offices.

TELEPHONE SERVICE FOR DEAF AND HARD OF HEARING PERSONS (TDD)

Deaf and hard of hearing taxpayers who have access to TDD equipment can use the Georgia Relay program. For more

information visit

PROBLEM RESOLUTION

For information concerning a notice or letter from the Department of Revenue, call the telephone number listed on the

document. For additional assistance, contact the Taxpayer Services Division at 1-877-423-6711 or the Taxpayer Advocate’s

Office at 404-417-2251 or via e-mail to taxpayer.advocate@dor.ga.gov. For additional assistance with e-file contact the

Department at 1-877-423-6711.

Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34