Form 65 Instructions - Partnership/limited Liability Company Return Of Income - 2011

ADVERTISEMENT

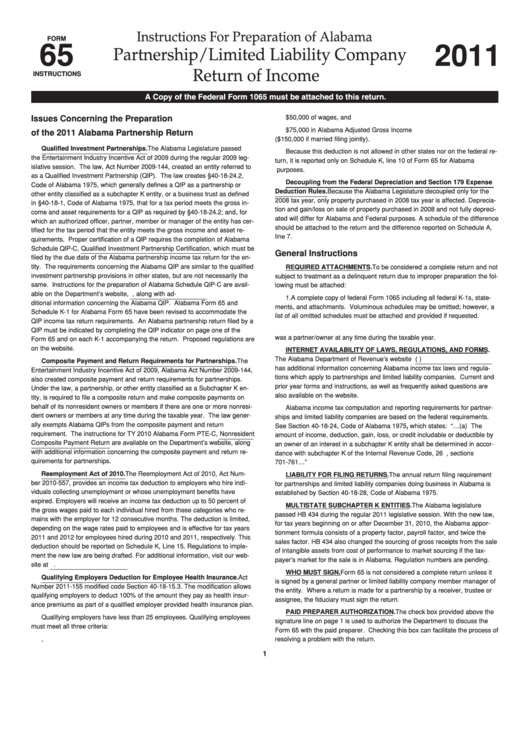

Instructions For Preparation of Alabama

FORM

2011

65

Partnership/Limited Liability Company

Return of Income

INSTRUCTIONS

A Copy of the Federal Form 1065 must be attached to this return.

Issues Concerning the Preparation

2. Earn no more than $50,000 of wages, and

3. Report no more than $75,000 in Alabama Adjusted Gross Income

of the 2011 Alabama Partnership Return

($150,000 if married filing jointly).

Qualified Investment Partnerships. The Alabama Legislature passed

Because this deduction is not allowed in other states nor on the federal re-

the Entertainment Industry Incentive Act of 2009 during the regular 2009 leg-

turn, it is reported only on Schedule K, line 10 of Form 65 for Alabama

islative session. The law, Act Number 2009-144, created an entity referred to

purposes.

as a Qualified Investment Partnership (QIP). The law creates §40-18-24.2,

Decoupling from the Federal Depreciation and Section 179 Expense

Code of Alabama 1975, which generally defines a QIP as a partnership or

Deduction Rules. Because the Alabama Legislature decoupled only for the

other entity classified as a subchapter K entity, or a business trust as defined

2008 tax year, only property purchased in 2008 tax year is affected. Deprecia-

in §40-18-1, Code of Alabama 1975, that for a tax period meets the gross in-

tion and gain/loss on sale of property purchased in 2008 and not fully depreci-

come and asset requirements for a QIP as required by §40-18-24.2; and, for

ated will differ for Alabama and Federal purposes. A schedule of the difference

which an authorized officer, partner, member or manager of the entity has cer-

should be attached to the return and the difference reported on Schedule A,

tified for the tax period that the entity meets the gross income and asset re-

line 7.

quirements. Proper certification of a QIP requires the completion of Alabama

Schedule QIP-C, Qualified Investment Partnership Certification, which must be

General Instructions

filed by the due date of the Alabama partnership income tax return for the en-

tity. The requirements concerning the Alabama QIP are similar to the qualified

REQUIRED ATTACHMENTS. To be considered a complete return and not

investment partnership provisions in other states, but are not necessarily the

subject to treatment as a delinquent return due to improper preparation the fol-

same. Instructions for the preparation of Alabama Schedule QIP-C are avail-

lowing must be attached:

able on the Department’s website, , along with ad-

1. A complete copy of federal Form 1065 including all federal K-1s, state-

ditional information concerning the Alabama QIP. Alabama Form 65 and

ments, and attachments. Voluminous schedules may be omitted; however, a

Schedule K-1 for Alabama Form 65 have been revised to accommodate the

list of all omitted schedules must be attached and provided if requested.

QIP income tax return requirements. An Alabama partnership return filed by a

2. Completed Alabama Schedule K-1 for each person or tax entity that

QIP must be indicated by completing the QIP indicator on page one of the

was a partner/owner at any time during the taxable year.

Form 65 and on each K-1 accompanying the return. Proposed regulations are

on the website.

INTERNET AVAILABILITY OF LAWS, REGULATIONS, AND FORMS.

The Alabama Department of Revenue’s website ( )

Composite Payment and Return Requirements for Partnerships. The

has additional information concerning Alabama income tax laws and regula-

Entertainment Industry Incentive Act of 2009, Alabama Act Number 2009-144,

tions which apply to partnerships and limited liability companies. Current and

also created composite payment and return requirements for partnerships.

prior year forms and instructions, as well as frequently asked questions are

Under the law, a partnership, or other entity classified as a Subchapter K en-

also available on the website.

tity, is required to file a composite return and make composite payments on

behalf of its nonresident owners or members if there are one or more nonresi-

Alabama income tax computation and reporting requirements for partner-

dent owners or members at any time during the taxable year. The law gener-

ships and limited liability companies are based on the federal requirements.

ally exempts Alabama QIPs from the composite payment and return

See Section 40-18-24, Code of Alabama 1975, which states: “…(a) The

requirement. The instructions for TY 2010 Alabama Form PTE-C, Nonresident

amount of income, deduction, gain, loss, or credit includable or deductible by

Composite Payment Return are available on the Department’s website, along

an owner of an interest in a subchapter K entity shall be determined in accor-

with additional information concerning the composite payment and return re-

dance with subchapter K of the Internal Revenue Code, 26 U.S.C., sections

quirements for partnerships.

701-761…”

Reemployment Act of 2010. The Reemployment Act of 2010, Act Num-

LIABILITY FOR FILING RETURNS. The annual return filing requirement

ber 2010-557, provides an income tax deduction to employers who hire indi-

for partnerships and limited liability companies doing business in Alabama is

viduals collecting unemployment or whose unemployment benefits have

established by Section 40-18-28, Code of Alabama 1975.

expired. Employers will receive an income tax deduction up to 50 percent of

MULTISTATE SUBCHAPTER K ENTITIES. The Alabama legislature

the gross wages paid to each individual hired from these categories who re-

passed HB 434 during the regular 2011 legislative session. With the new law,

mains with the employer for 12 consecutive months. The deduction is limited,

for tax years beginning on or after December 31, 2010, the Alabama appor-

depending on the wage rates paid to employees and is effective for tax years

tionment formula consists of a property factor, payroll factor, and twice the

2011 and 2012 for employees hired during 2010 and 2011, respectively. This

sales factor. HB 434 also changed the sourcing of gross receipts from the sale

deduction should be reported on Schedule K, Line 15. Regulations to imple-

of intangible assets from cost of performance to market sourcing if the tax-

ment the new law are being drafted. For additional information, visit our web-

payer’s market for the sale is in Alabama. Regulation numbers are pending.

site at .

WHO MUST SIGN. Form 65 is not considered a complete return unless it

Qualifying Employers Deduction for Employee Health Insurance. Act

is signed by a general partner or limited liability company member manager of

Number 2011-155 modified code Section 40-18-15.3. The modification allows

the entity. Where a return is made for a partnership by a receiver, trustee or

qualifying employers to deduct 100% of the amount they pay as health insur-

assignee, the fiduciary must sign the return.

ance premiums as part of a qualified employer provided health insurance plan.

PAID PREPARER AUTHORIZATION. The check box provided above the

Qualifying employers have less than 25 employees. Qualifying employees

signature line on page 1 is used to authorize the Department to discuss the

must meet all three criteria:

Form 65 with the paid preparer. Checking this box can facilitate the process of

1. Alabama residents,

resolving a problem with the return.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5