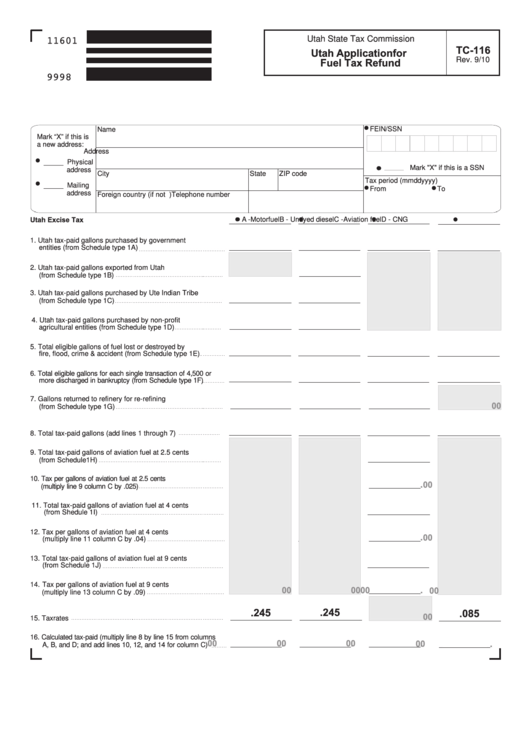

Utah State Tax Commission

11601

TC-116

Utah Application for

Rev. 9/10

Fuel Tax Refund

9998

FEIN/SSN

Name

Mark “X” if this is

a new address:

Address

_____ Physical

_____

Mark "X" if this is a SSN

address

City

State

ZIP code

Tax period (mmddyyyy)

_____ Mailing

From

To

address

Foreign country (if not U.S.)

Telephone number

A - Motor fuel

B - Undyed diesel

C - Aviation fuel

D - CNG

Utah Excise Tax

1. Utah tax-paid gallons purchased by government

entities (from Schedule type 1A)

2. Utah tax-paid gallons exported from Utah

(from Schedule type 1B)

3. Utah tax-paid gallons purchased by Ute Indian Tribe

(from Schedule type 1C)

4. Utah tax-paid gallons purchased by non-profit

agricultural entities (from Schedule type 1D)

5. Total eligible gallons of fuel lost or destroyed by

fire, flood, crime & accident (from Schedule type 1E)

6. Total eligible gallons for each single transaction of 4,500 or

more discharged in bankruptcy (from Schedule type 1F)

7. Gallons returned to refinery for re-refining

00

(from Schedule type 1G)

8. Total tax-paid gallons (add lines 1 through 7)

9. Total tax-paid gallons of aviation fuel at 2.5 cents

(from Schedule1H)

10. Tax per gallons of aviation fuel at 2.5 cents

00

(multiply line 9 column C by .025)

11. Total tax-paid gallons of aviation fuel at 4 cents

(from Shedule 1I)

12. Tax per gallons of aviation fuel at 4 cents

00

(multiply line 11 column C by .04)

13. Total tax-paid gallons of aviation fuel at 9 cents

(from Schedule 1J)

14.

Tax per gallons of aviation fuel at 9 cents

00

00

00

00

(multiply line 13 column C by .09)

.245

.245

.085

00

15. Tax rates

16. Calculated tax-paid (multiply line 8 by line 15 from columns

00

00

00

00

A, B, and D; and add lines 10, 12, and 14 for column C)

1

1 2

2 3

3