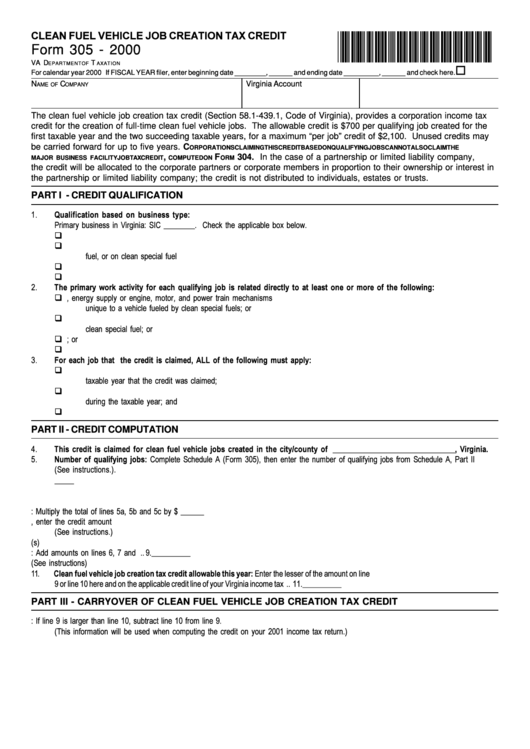

Form 305 - Clean Fuel Vehicle Job Creation Tax Credit - 2000

ADVERTISEMENT

The clean fuel vehicle job creation tax credit (Section 58.1-439.1, Code of Virginia), provides a corporation income tax

credit for the creation of full-time clean fuel vehicle jobs. The allowable credit is $700 per qualifying job created for the

first taxable year and the two succeeding taxable years, for a maximum “per job” credit of $2,100. Unused credits may

be carried forward for up to five years. C

ORPORATIONS CLAIMING THIS CREDIT BASED ON QUALIFYING JOBS CANNOT ALSO CLAIM THE

,

F

304. In the case of a partnership or limited liability company,

MAJOR BUSINESS FACILITY JOB TAX CREDIT

COMPUTED ON

ORM

the credit will be allocated to the corporate partners or corporate members in proportion to their ownership or interest in

the partnership or limited liability company; the credit is not distributed to individuals, estates or trusts.

PART I - CREDIT QUALIFICATION

PART II - CREDIT COMPUTATION

PART III - CARRYOVER OF CLEAN FUEL VEHICLE JOB CREATION TAX CREDIT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1