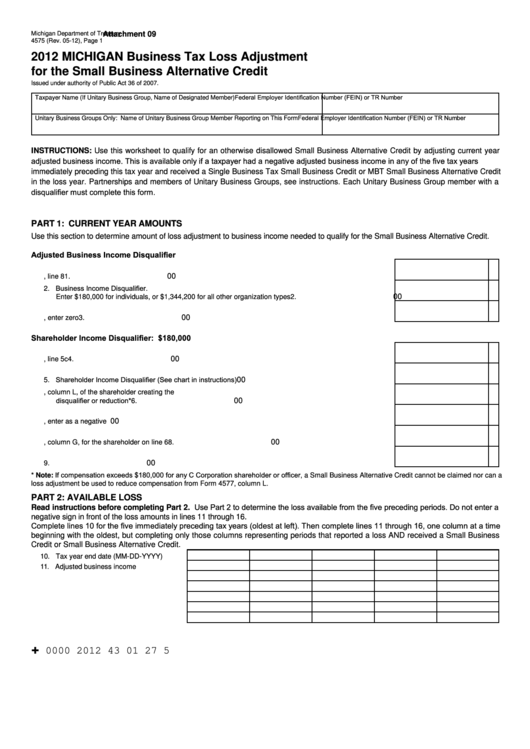

Form 4575 - Michigan Business Tax Loss Adjustment For The Small Business Alternative Credit - 2012

ADVERTISEMENT

Michigan Department of Treasury

Attachment 09

4575 (Rev. 05-12), Page 1

2012 MICHIGAN Business Tax Loss Adjustment

for the Small Business Alternative Credit

Issued under authority of Public Act 36 of 2007.

Federal Employer Identification Number (FEIN) or TR Number

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN) or TR Number

Unitary Business Groups Only: Name of Unitary Business Group Member Reporting on This Form

INSTRUCTIONS: Use this worksheet to qualify for an otherwise disallowed Small Business Alternative Credit by adjusting current year

adjusted business income. This is available only if a taxpayer had a negative adjusted business income in any of the five tax years

immediately preceding this tax year and received a Single Business Tax Small Business Credit or MBT Small Business Alternative Credit

in the loss year. Partnerships and members of Unitary Business Groups, see instructions. Each Unitary Business Group member with a

disqualifier must complete this form.

PART 1: CURRENT YEAR AMOUNTS

Use this section to determine amount of loss adjustment to business income needed to qualify for the Small Business Alternative Credit.

Adjusted Business Income Disqualifier

00

1. Adjusted Business Income from Form 4571, line 8 ...................................................................................

1.

2. Business Income Disqualifier.

00

Enter $180,000 for individuals, or $1,344,200 for all other organization types .........................................

2.

00

3. Loss adjustment required. Subtract line 2 from line 1. If less than zero, enter zero ..................................

3.

Shareholder Income Disqualifier: $180,000

00

4. Enter the amount from Form 4571, line 5c ................................................................................................

4.

5. Shareholder Income Disqualifier (See chart in instructions)......................................................................

00

5.

6. Enter compensation and director fees from Form 4577, column L, of the shareholder creating the

disqualifier or reduction* ............................................................................................................................

00

6.

00

7. Subtract line 6 from line 5. If less than zero, enter as a negative number.................................................

7.

00

8. Divide line 7 by the percent of ownership from Form 4577, column G, for the shareholder on line 6 .......

8.

00

9. Loss adjustment required. Subtract line 8 from line 4 ...............................................................................

9.

* Note: If compensation exceeds $180,000 for any C Corporation shareholder or officer, a Small Business Alternative Credit cannot be claimed nor can a

loss adjustment be used to reduce compensation from Form 4577, column L.

PART 2: AVAILABLE LOSS

Read instructions before completing Part 2. Use Part 2 to determine the loss available from the five preceding periods. Do not enter a

negative sign in front of the loss amounts in lines 11 through 16.

Complete lines 10 for the five immediately preceding tax years (oldest at left). Then complete lines 11 through 16, one column at a time

beginning with the oldest, but completing only those columns representing periods that reported a loss AND received a Small Business

Credit or Small Business Alternative Credit.

10. Tax year end date (MM-DD-YYYY) ..........

11. Adjusted business income .......................

12. Loss used on prior returns .......................

13. Loss available for current return ..............

14. Loss adjustment required ........................

15. Remaining loss adjustment required .......

16. Loss adjustment carryforward .................

+

0000 2012 43 01 27 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6