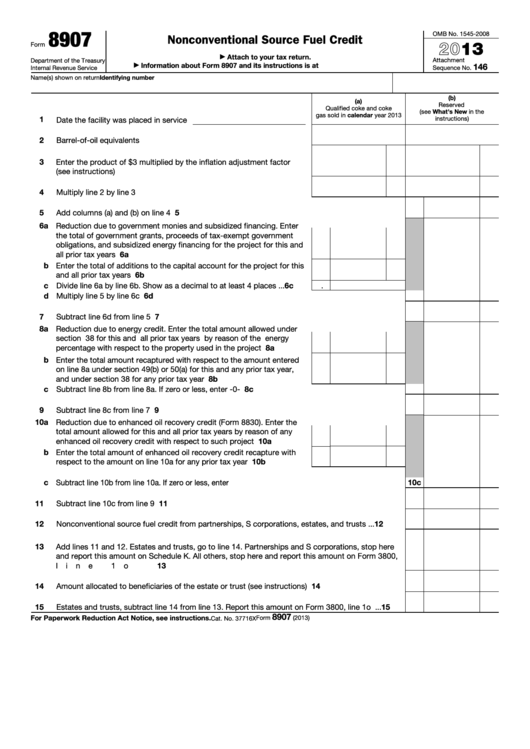

8907

OMB No. 1545-2008

Nonconventional Source Fuel Credit

2013

Form

Attach to your tax return.

▶

Attachment

Department of the Treasury

Information about Form 8907 and its instructions is at

146

▶

Internal Revenue Service

Sequence No.

Identifying number

Name(s) shown on return

(b)

(a)

Reserved

Qualified coke and coke

(see What's New in the

gas sold in calendar year 2013

1

instructions)

Date the facility was placed in service

2

Barrel-of-oil equivalents .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Enter the product of $3 multiplied by the inflation adjustment factor

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Multiply line 2 by line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Add columns (a) and (b) on line 4 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 a Reduction due to government monies and subsidized financing. Enter

the total of government grants, proceeds of tax-exempt government

obligations, and subsidized energy financing for the project for this and

6a

all prior tax years

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Enter the total of additions to the capital account for the project for this

and all prior tax years .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6b

c Divide line 6a by line 6b. Show as a decimal to at least 4 places .

6c

.

.

.

d Multiply line 5 by line 6c .

6d

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Subtract line 6d from line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8 a Reduction due to energy credit. Enter the total amount allowed under

section 38 for this and all prior tax years by reason of the energy

percentage with respect to the property used in the project

.

.

.

.

8a

b Enter the total amount recaptured with respect to the amount entered

on line 8a under section 49(b) or 50(a) for this and any prior tax year,

and under section 38 for any prior tax year .

.

.

.

.

.

.

.

.

.

8b

c Subtract line 8b from line 8a. If zero or less, enter -0-

8c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Subtract line 8c from line 7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10 a Reduction due to enhanced oil recovery credit (Form 8830). Enter the

total amount allowed for this and all prior tax years by reason of any

enhanced oil recovery credit with respect to such project .

.

.

.

.

10a

b Enter the total amount of enhanced oil recovery credit recapture with

10b

respect to the amount on line 10a for any prior tax year

.

.

.

.

.

c Subtract line 10b from line 10a. If zero or less, enter -0-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10c

11

Subtract line 10c from line 9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Nonconventional source fuel credit from partnerships, S corporations, estates, and trusts

.

.

.

12

13

Add lines 11 and 12. Estates and trusts, go to line 14. Partnerships and S corporations, stop here

and report this amount on Schedule K. All others, stop here and report this amount on Form 3800,

13

line 1o .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

Amount allocated to beneficiaries of the estate or trust (see instructions) .

.

.

.

.

.

.

.

.

14

15

Estates and trusts, subtract line 14 from line 13. Report this amount on Form 3800, line 1o .

.

.

15

8907

For Paperwork Reduction Act Notice, see instructions.

Form

(2013)

Cat. No. 37716X

1

1 2

2