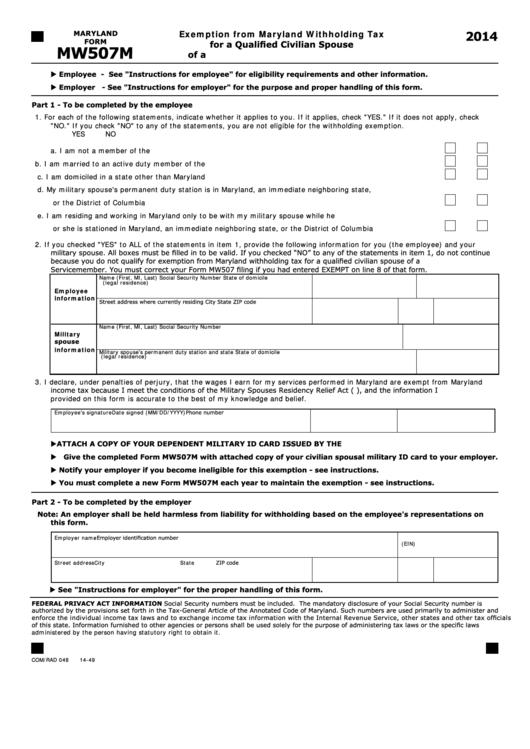

Exemption from Maryland Withholding Tax

2014

MARYLAND

FORM

for a Qualified Civilian Spouse

MW507M

of a U.S. Armed Forces Servicemember

u Employee -

See "Instructions for employee" for eligibility requirements and other information.

u Employer -

See "Instructions for employer" for the purpose and proper handling of this form.

Part 1 - To be completed by the employee

1.

For each of the following statements, indicate whether it applies to you. If it applies, check "YES." If it does not apply, check

"NO." If you check "NO" to any of the statements, you are not eligible for the withholding exemption.

YES

NO

a. I am not a member of the U.S. armed forces . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b. I am married to an active duty member of the U.S. armed forces . . . . . . . . . . . . . . . . . . . . . . . . . . .

c. I am domiciled in a state other than Maryland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d. My military spouse's permanent duty station is in Maryland, an immediate neighboring state,

or the District of Columbia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e. I am residing and working in Maryland only to be with my military spouse while he

or she is stationed in Maryland, an immediate neighboring state, or the District of Columbia . . . . . . . .

2.

If you checked "YES" to ALL of the statements in item 1, provide the following information for you (the employee) and your

military spouse. All boxes must be filled in to be valid. If you checked “NO” to any of the statements in item 1, do not continue

because you do not qualify for exemption from Maryland withholding tax for a qualified civilian spouse of a U.S. Armed Forces

Servicemember. You must correct your Form MW507 filing if you had entered EXEMPT on line 8 of that form.

Name (First, MI, Last)

Social Security Number

State of domicile

(legal residence)

Employee

information

Street address where currently residing

City

State

ZIP code

Name (First, MI, Last)

Social Security Number

Military

spouse

information

Military spouse’s permanent duty station and state

State of domicile

(legal residence)

3.

I declare, under penalties of perjury, that the wages I earn for my services performed in Maryland are exempt from Maryland

income tax because I meet the conditions of the Military Spouses Residency Relief Act (P.L. 111-97), and the information I

provided on this form is accurate to the best of my knowledge and belief.

Employee's signature

Date signed (MM/DD/YYYY)

Phone number

u ATTACH A COPY OF YOUR DEPENDENT MILITARY ID CARD ISSUED BY THE U.S. DEPT. OF DEFENSE

u Give the completed Form MW507M with attached copy of your civilian spousal military ID card to your employer.

u Notify your employer if you become ineligible for this exemption - see instructions.

u You must complete a new Form MW507M each year to maintain the exemption - see instructions.

Part 2 - To be completed by the employer

Note: An employer shall be held harmless from liability for withholding based on the employee's representations on

this form.

Employer name

Employer identification number

(EIN)

Street address

City

State

ZIP code

u See "Instructions for employer" for the proper handling of this form.

FEDERAL PRIVACY ACT INFORMATION Social Security numbers must be included. The mandatory disclosure of your Social Security number is

authorized by the provisions set forth in the Tax-General Article of the Annotated Code of Maryland. Such numbers are used primarily to administer and

enforce the individual income tax laws and to exchange income tax information with the Internal Revenue Service, other states and other tax officials

of this state. Information furnished to other agencies or persons shall be used solely for the purpose of administering tax laws or the specific laws

administered by the person having statutory right to obtain it.

COM/RAD 048

14-49

1

1 2

2