Instructions For Form 41est - Idaho Business Income Tax Payments

ADVERTISEMENT

EIN00035

Instructions for Idaho Form 41EST

08-27-14

WHO MUST MAKE ESTIMATED TAX PAYMENTS

taxpayers, estimated tax payments are due by the 15th day of the 4th,

6th, 9th, and 12th months of the tax year.

A corporation must make estimated tax payments to the Tax Commission

if it is required to make estimated tax payments to the Internal Revenue

The due dates for the federal and Idaho estimated tax payments are the

same. If the due date is on a Saturday, Sunday, or legal holiday, the

Service and will have an Idaho income tax liability of $500 or more.

payment is due on the next regular business day.

Estimated tax payments aren’t required if the corporation wasn’t required

to file an Idaho return the previous tax year.

UNDERPAYMENT OF ESTIMATED TAX

If you received personalized payment vouchers, use the appropriate

voucher for each filing period. If any of the preprinted information is

Interest is due on the difference between the amount of estimated tax

incorrect, draw a line through it and enter the correct information. Check

payment required to be made on each voucher and the amount of

the box on the voucher if there is a change in your mailing address.

estimated tax payment actually made. Interest is computed from the due

date of the estimated payment until the required amount is paid or until

If you don’t have a preprinted form, use the Form 41ES. You can find it

the due date of the return. The interest rate for 2014 is 4%. Interest rate

on our website at tax.idaho.gov.

for 2015 is 4%.

ESTIMATED TAX PAYMENTS

Use Form 41ESR to determine the amount of any underpayments of tax

and interest due when you file your return.

Each estimated tax payment must be 25% of the lesser of the tax

required to be reported on the corporation’s return for the prior year, or

OVERPAYMENT OF ESTIMATED TAX

90% of the income tax required to be paid on the current year’s return.

Excess estimated tax payments will be refunded after you file the

Don’t include fuels tax, sales/use tax, fuels tax refunds, tax from the

recapture of qualified investment exemption (QIE) or Hire One Act credit

completed return. You may apply all or part of the excess to next year’s

estimated tax by designating the amount on the Idaho Corporation

reported on the income tax returns.

Income Tax Return, Form 41, or the Idaho S Corporation Income Tax

For corporations, the tax required to be reported is defined as Idaho

Return, Form 41S.

taxable income multiplied by the appropriate tax rate, plus the permanent

building fund tax, plus tax from recapture of business income tax credits,

Overpayments will be applied to any prior year tax liabilities before

minus allowable income tax credits. A corporation making estimated tax

carryovers or refunds are allowed. You will be notified if your

payments in a year following the revocation of subchapter S status will

overpayment is applied to an existing liability, or is used to reduce your

use $20 as the tax amount required to be reported on the prior year’s

refund or carryover.

return.

ANNUALIZED INCOME AND ESTIMATED TAX PAYMENTS

For S corporations, estimated tax payments are computed on the Idaho

tax due to net recognized built-in gains and excess net passive income.

If your estimated payments are based on annualized income for federal

Estimated tax payments aren’t required on the tax due on income being

purposes, you may use that same method for making Idaho estimated

reported for individual shareholders.

tax payments. The estimated tax due for the installment period is

calculated by multiplying the applicable percentage (22.5%, 45%, 67.5%,

and 90% for the 1st, 2nd, 3rd, and 4th installments, respectively) by the

COMPUTATION OF ESTIMATED TAX PAYMENTS

full year’s tax on the annualized income for the period and deducting any

The Form 41EST worksheet allows you to compare the income tax on

prior installments.

last year’s return with the anticipated income tax for the current year. Use

the smaller of the two amounts to determine the estimated tax payment

SHORT TAX YEAR

for each period. If your estimated tax payments are based on 90% of

If the short tax year ends before any remaining due dates, you must

the income tax required to be paid on the current year’s return and the

make a final estimated tax payment by the 15th day of the last month of

anticipated income tax for the current year is revised, use the revised

amount to recompute any remaining estimated tax payments.

the short tax year. No estimated tax payment is required if the short tax

year is less than four months or if the requirements to make an estimated

tax payment are not met before the first day of the last month in the short

DUE DATES

tax year.

For calendar year taxpayers, estimated tax payments are due by the

15th day of April, June, September, and December. For fiscal year

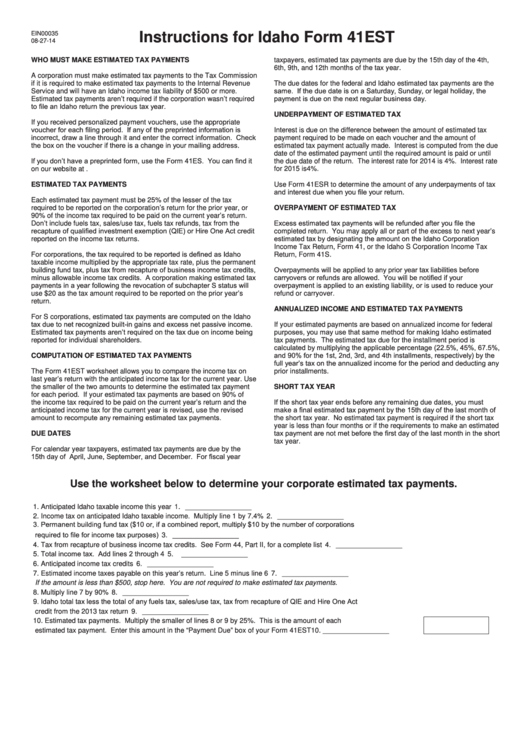

Use the worksheet below to determine your corporate estimated tax payments.

1.

Anticipated Idaho taxable income this year .............................................................................................................. 1.

_________________

2.

Income tax on anticipated Idaho taxable income. Multiply line 1 by 7.4% ............................................................... 2.

_________________

3.

Permanent building fund tax ($10 or, if a combined report, multiply $10 by the number of corporations

required to file for income tax purposes) .................................................................................................................. 3.

_________________

4.

Tax from recapture of business income tax credits. See Form 44, Part II, for a complete list ................................. 4.

_________________

5.

Total income tax. Add lines 2 through 4 ................................................................................................................... 5.

_________________

6.

Anticipated income tax credits .................................................................................................................................. 6.

_________________

7.

Estimated income taxes payable on this year’s return. Line 5 minus line 6 ............................................................ 7.

_________________

If the amount is less than $500, stop here. You are not required to make estimated tax payments.

8.

Multiply line 7 by 90% ............................................................................................................................................... 8.

_________________

9.

Idaho total tax less the total of any fuels tax, sales/use tax, tax from recapture of QIE and Hire One Act

credit from the 2013 tax return .................................................................................................................................. 9.

_________________

10.

Estimated tax payments. Multiply the smaller of lines 8 or 9 by 25%. This is the amount of each

estimated tax payment. Enter this amount in the “Payment Due” box of your Form 41EST ................................... 10.

_________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1