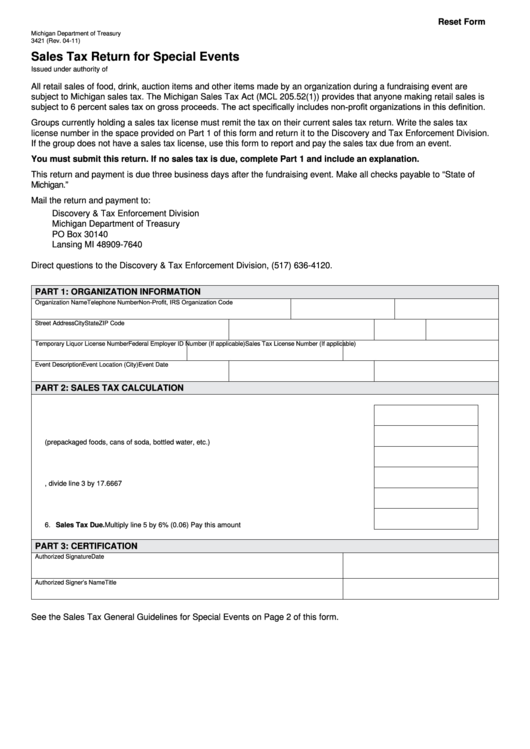

Reset Form

Michigan Department of Treasury

3421 (Rev. 04-11)

Sales Tax Return for Special Events

Issued under authority of P.A. 167 of 1933 and 122 of 1941 as amended. Filing is mandatory.

All retail sales of food, drink, auction items and other items made by an organization during a fundraising event are

subject to Michigan sales tax. The Michigan Sales Tax Act (MCL 205.52(1)) provides that anyone making retail sales is

subject to 6 percent sales tax on gross proceeds. The act specifically includes non-profit organizations in this definition.

Groups currently holding a sales tax license must remit the tax on their current sales tax return. Write the sales tax

license number in the space provided on Part 1 of this form and return it to the Discovery and Tax Enforcement Division.

If the group does not have a sales tax license, use this form to report and pay the sales tax due from an event.

You must submit this return. If no sales tax is due, complete Part 1 and include an explanation.

This return and payment is due three business days after the fundraising event. Make all checks payable to “State of

Michigan.”

Mail the return and payment to:

Discovery & Tax Enforcement Division

Michigan Department of Treasury

PO Box 30140

Lansing MI 48909-7640

Direct questions to the Discovery & Tax Enforcement Division, (517) 636-4120.

PaRT 1: ORganIzaTIOn InfORmaTIOn

Non-Profit, IRS Organization Code

Organization Name

Telephone Number

Street Address

City

State

ZIP Code

Temporary Liquor License Number

Federal Employer ID Number (If applicable)

Sales Tax License Number (If applicable)

Event Description

Event Location (City)

Event Date

PaRT 2: SalES Tax CalCulaTIOn

1. Gross Sales. Enter your total gross sales from this event ................................................................

1.

2. Enter your total sales of exempt items (prepackaged foods, cans of soda, bottled water, etc.) ......

2.

3. Subtract line 2 from line 1 .................................................................................................................

3.

4. If tax is included in gross sales from line 1, divide line 3 by 17.6667 ...............................................

4.

5. Taxable Sales. Subtract line 4 from line 3 ........................................................................................

5.

6. Sales Tax Due. Multiply line 5 by 6% (0.06) Pay this amount .........................................................

6.

PaRT 3: CERTIfICaTIOn

Authorized Signature

Date

Authorized Signer’s Name

Title

See the Sales Tax General Guidelines for Special Events on Page 2 of this form.

1

1 2

2