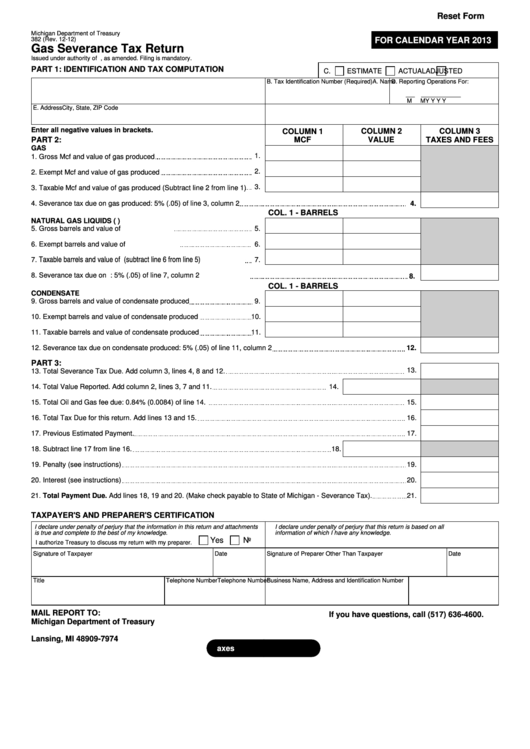

Reset Form

Michigan Department of Treasury

FOR CALENDAR YEAR 2013

382 (Rev. 12-12)

Gas Severance Tax Return

Issued under authority of P.A. 48 of 1929, as amended. Filing is mandatory.

PART 1: IDENTIFICATION AND TAX COMPUTATION

C.

ESTIMATE

ACTUAL

ADJUSTED

A. Name

B. Tax Identification Number (Required)

D. Reporting Operations For:

__ __

_______

M

M

Y Y Y Y

E. Address

City, State, ZIP Code

Enter all negative values in brackets.

COLUMN 1

COLUMN 2

COLUMN 3

PART 2:

MCF

VALUE

TAXES AND FEES

GAS

1.

1. Gross Mcf and value of gas produced

2.

2. Exempt Mcf and value of gas produced

3.

3. Taxable Mcf and value of gas produced (Subtract line 2 from line 1)

4. Severance tax due on gas produced: 5% (.05) of line 3, column 2

4.

COL. 1 - BARRELS

NATURAL GAS LIQUIDS (N.G.Ls)

5. Gross barrels and value of N.G.Ls produced

5.

6. Exempt barrels and value of N.G.Ls produced

6.

Taxable barrels and value of N.G.Ls produced(subtract line 6 from line 5)

7.

7.

8. Severance tax due on N.G.Ls produced: 5% (.05) of line 7, column 2

8.

COL. 1 - BARRELS

CONDENSATE

9. Gross barrels and value of condensate produced

9.

10. Exempt barrels and value of condensate produced

10.

11. Taxable barrels and value of condensate produced

11.

12. Severance tax due on condensate produced: 5% (.05) of line 11, column 2

12.

PART 3:

13.

13. Total Severance Tax Due. Add column 3, lines 4, 8 and 12.

14. Total Value Reported. Add column 2, lines 3, 7 and 11.

14.

15. Total Oil and Gas fee due: 0.84% (0.0084) of line 14.

15.

16. Total Tax Due for this return. Add lines 13 and 15.

16.

17. Previous Estimated Payment.

17.

18. Subtract line 17 from line 16.

18.

19. Penalty (see instructions)

19.

20. Interest (see instructions)

20.

21. Total Payment Due. Add lines 18, 19 and 20. (Make check payable to State of Michigan - Severance Tax).

21.

TAXPAYER'S AND PREPARER'S CERTIFICATION

I declare under penalty of perjury that the information in this return and attachments

I declare under penalty of perjury that this return is based on all

is true and complete to the best of my knowledge.

information of which I have any knowledge.

Yes

No

I authorize Treasury to discuss my return with my preparer.

Signature of Taxpayer

Date

Signature of Preparer Other Than Taxpayer

Date

Title

Telephone Number

Business Name, Address and Identification Number

Telephone Number

MAIL REPORT TO:

If you have questions, call (517) 636-4600.

Michigan Department of Treasury

P.O. Box 30474

Lansing, MI 48909-7974

1

1 2

2 3

3