Form 770es - Virginia Estimated Income Tax Payment Vouchers For Estates, Trusts And Unified Nonresidents - 2012

ADVERTISEMENT

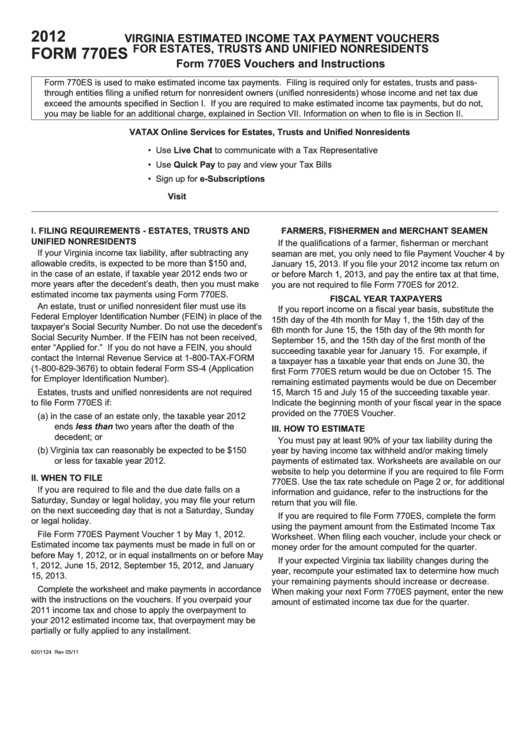

2012

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS

FOR ESTATES, TRUSTS AND UNIFIED NONRESIDENTS

FORM 770ES

Form 770ES Vouchers and Instructions

Form 770ES is used to make estimated income tax payments. Filing is required only for estates, trusts and pass-

through entities filing a unified return for nonresident owners (unified nonresidents) whose income and net tax due

exceed the amounts specified in Section I. If you are required to make estimated income tax payments, but do not,

you may be liable for an additional charge, explained in Section VII. Information on when to file is in Section II.

VATAX Online Services for Estates, Trusts and Unified Nonresidents

• Use Live Chat to communicate with a Tax Representative

• Use Quick Pay to pay and view your Tax Bills

• Sign up for e-Subscriptions

Visit for more information

I. FILING REQUIREMENTS - ESTATES, TRUSTS AND

FARMERS, FISHERMEN and MERCHANT SEAMEN

UNIFIED NONRESIDENTS

If the qualifications of a farmer, fisherman or merchant

If your Virginia income tax liability, after subtracting any

seaman are met, you only need to file Payment Voucher 4 by

allowable credits, is expected to be more than $150 and,

January 15, 2013. If you file your 2012 income tax return on

in the case of an estate, if taxable year 2012 ends two or

or before March 1, 2013, and pay the entire tax at that time,

more years after the decedent’s death, then you must make

you are not required to file Form 770ES for 2012.

estimated income tax payments using Form 770ES.

FISCAL YEAR TAXPAYERS

An estate, trust or unified nonresident filer must use its

If you report income on a fiscal year basis, substitute the

Federal Employer Identification Number (FEIN) in place of the

15th day of the 4th month for May 1, the 15th day of the

taxpayer’s Social Security Number. Do not use the decedent’s

6th month for June 15, the 15th day of the 9th month for

Social Security Number. If the FEIN has not been received,

September 15, and the 15th day of the first month of the

enter “Applied for.” If you do not have a FEIN, you should

succeeding taxable year for January 15. For example, if

contact the Internal Revenue Service at 1-800-TAX-FORM

a taxpayer has a taxable year that ends on June 30, the

(1-800-829-3676) to obtain federal Form SS-4 (Application

first Form 770ES return would be due on October 15. The

for Employer Identification Number).

remaining estimated payments would be due on December

Estates, trusts and unified nonresidents are not required

15, March 15 and July 15 of the succeeding taxable year.

to file Form 770ES if:

Indicate the beginning month of your fiscal year in the space

provided on the 770ES Voucher.

(a) in the case of an estate only, the taxable year 2012

ends less than two years after the death of the

III. HOW TO ESTIMATE

decedent; or

You must pay at least 90% of your tax liability during the

(b) Virginia tax can reasonably be expected to be $150

year by having income tax withheld and/or making timely

or less for taxable year 2012.

payments of estimated tax. Worksheets are available on our

website to help you determine if you are required to file Form

II. WHEN TO FILE

770ES. Use the tax rate schedule on Page 2 or, for additional

If you are required to file and the due date falls on a

information and guidance, refer to the instructions for the

Saturday, Sunday or legal holiday, you may file your return

return that you will file.

on the next succeeding day that is not a Saturday, Sunday

If you are required to file Form 770ES, complete the form

or legal holiday.

using the payment amount from the Estimated Income Tax

File Form 770ES Payment Voucher 1 by May 1, 2012.

Worksheet. When filing each voucher, include your check or

Estimated income tax payments must be made in full on or

money order for the amount computed for the quarter.

before May 1, 2012, or in equal installments on or before May

If your expected Virginia tax liability changes during the

1, 2012, June 15, 2012, September 15, 2012, and January

year, recompute your estimated tax to determine how much

15, 2013.

your remaining payments should increase or decrease.

Complete the worksheet and make payments in accordance

When making your next Form 770ES payment, enter the new

with the instructions on the vouchers. If you overpaid your

amount of estimated income tax due for the quarter.

2011 income tax and chose to apply the overpayment to

your 2012 estimated income tax, that overpayment may be

partially or fully applied to any installment.

6201124 Rev 05/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7