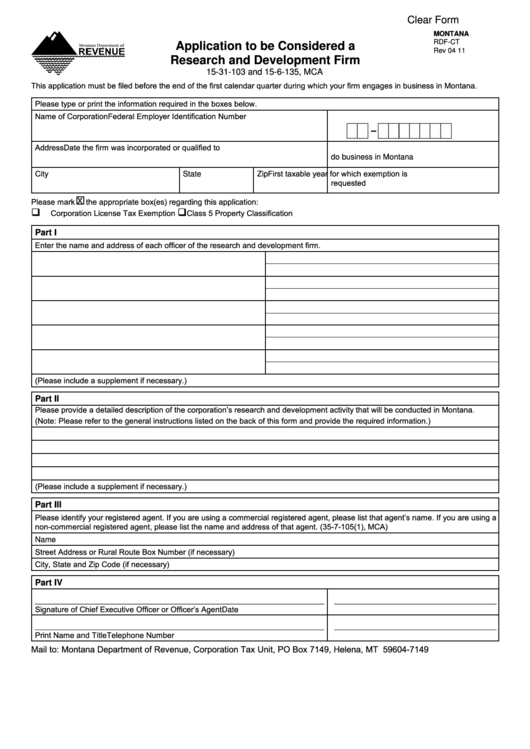

Clear Form

MONTANA

RDF-CT

Application to be Considered a

Rev 04 11

Research and Development Firm

15-31-103 and 15-6-135, MCA

This application must be filed before the end of the first calendar quarter during which your firm engages in business in Montana.

Please type or print the information required in the boxes below.

Name of Corporation

Federal Employer Identification Number

-

Address

Date the firm was incorporated or qualified to

do business in Montana

City

First taxable year for which exemption is

State

Zip

requested

Please mark

the appropriate box(es) regarding this application:

X

Corporation License Tax Exemption

Class 5 Property Classification

Part I

Enter the name and address of each officer of the research and development firm.

(Please include a supplement if necessary.)

Part II

Please provide a detailed description of the corporation’s research and development activity that will be conducted in Montana.

(Note: Please refer to the general instructions listed on the back of this form and provide the required information.)

(Please include a supplement if necessary.)

Part III

Please identify your registered agent. If you are using a commercial registered agent, please list that agent’s name. If you are using a

non-commercial registered agent, please list the name and address of that agent. (35-7-105(1), MCA)

Name

Street Address or Rural Route Box Number (if necessary)

City, State and Zip Code (if necessary)

Part IV

__________________________________________________________________

_____________________________________

Signature of Chief Executive Officer or Officer’s Agent

Date

__________________________________________________________________

_____________________________________

Print Name and Title

Telephone Number

Mail to: Montana Department of Revenue, Corporation Tax Unit, PO Box 7149, Helena, MT 59604-7149

1

1 2

2