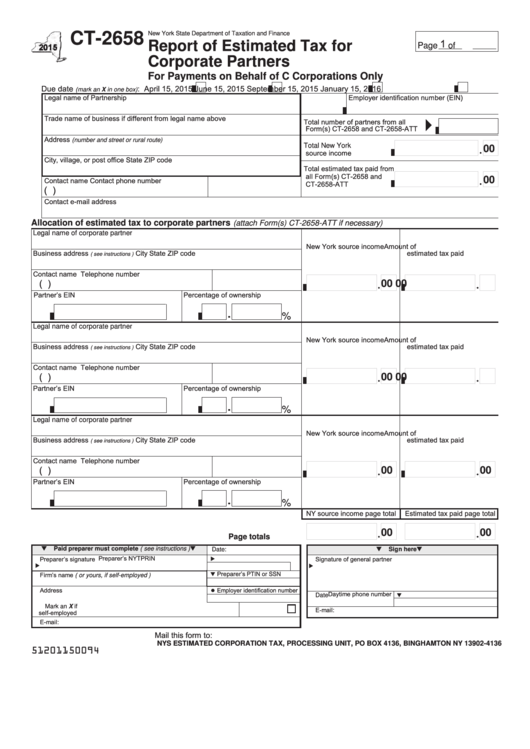

CT-2658

New York State Department of Taxation and Finance

1

Report of Estimated Tax for

Page

of

Corporate Partners

For Payments on Behalf of C Corporations Only

Due date

: April 15, 2015

June 15, 2015

September 15, 2015

January 15, 2016

(mark an X in one box)

Legal name of Partnership

Employer identification number (EIN)

Trade name of business if different from legal name above

Total number of partners from all

Form(s) CT‑2658 and CT‑2658‑ATT

Address

(number and street or rural route)

Total New York

00

source income ................

City, village, or post office

State

ZIP code

Total estimated tax paid from

all Form(s) CT‑2658 and

00

Contact name

Contact phone number

CT‑2658‑ATT ..................

(

)

Contact e‑mail address

Allocation of estimated tax to corporate partners

(attach Form(s) CT-2658-ATT if necessary)

Legal name of corporate partner

New York source income

Amount of

Business address

City

State

ZIP code

estimated tax paid

( see instructions )

Contact name

Telephone number

(

)

00

00

Partner’s EIN

Percentage of ownership

%

Legal name of corporate partner

New York source income

Amount of

Business address

City

State

ZIP code

estimated tax paid

( see instructions )

Contact name

Telephone number

(

)

00

00

Partner’s EIN

Percentage of ownership

%

Legal name of corporate partner

New York source income

Amount of

Business address

City

State

ZIP code

estimated tax paid

( see instructions )

Contact name

Telephone number

(

)

00

00

Partner’s EIN

Percentage of ownership

%

NY source income page total

Estimated tax paid page total

00

00

Page totals ...............

Paid preparer must complete ( see instructions )

Sign here

Date:

Preparer’s NYTPRIN

Preparer’s signature

Signature of general partner

Preparer’s PTIN or SSN

Firm’s name ( or yours, if self-employed )

Address

Employer identification number

Daytime phone number

Date

Mark an X if

E‑mail:

self‑employed

E‑mail:

Mail this form to:

NYS ESTIMATED CORPORATION TAX, PROCESSING UNIT, PO BOX 4136, BINGHAMTON NY 13902-4136

51201150094

1

1 2

2