Form Llc-3 - Instructions For Completing The Certificate Of Dissolution

ADVERTISEMENT

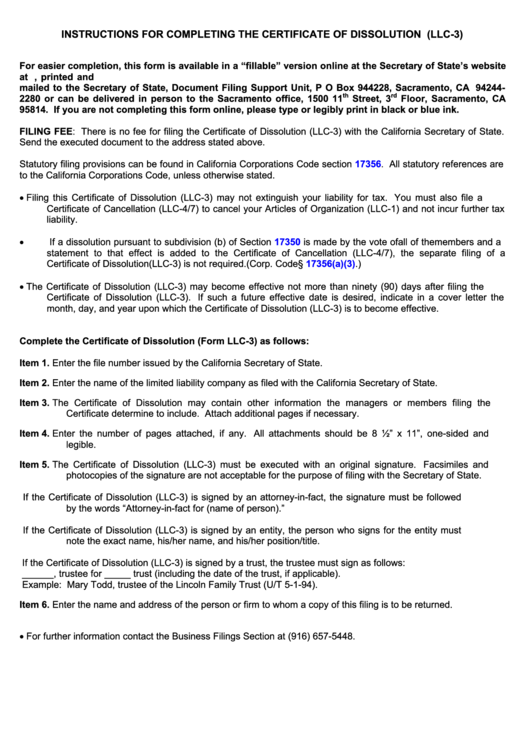

INSTRUCTIONS FOR COMPLETING THE CERTIFICATE OF DISSOLUTION (LLC-3)

For easier completion, this form is available in a “fillable” version online at the Secretary of State’s website

at The form can be filled in on your computer, printed and

mailed to the Secretary of State, Document Filing Support Unit, P O Box 944228, Sacramento, CA 94244-

th

rd

2280 or can be delivered in person to the Sacramento office, 1500 11

Street, 3

Floor, Sacramento, CA

95814. If you are not completing this form online, please type or legibly print in black or blue ink.

FILING FEE: There is no fee for filing the Certificate of Dissolution (LLC-3) with the California Secretary of State.

Send the executed document to the address stated above.

Statutory filing provisions can be found in California Corporations Code section 17356. All statutory references are

to the California Corporations Code, unless otherwise stated.

•

Filing this Certificate of Dissolution (LLC-3) may not extinguish your liability for tax. You must also file a

Certificate of Cancellation (LLC-4/7) to cancel your Articles of Organization (LLC-1) and not incur further tax

liability.

•

17350

If a dissolution pursuant to subdivision (b) of Section

is made by the vote of all of the members and a

statement to that effect is added to the Certificate of Cancellation (LLC-4/7), the separate filing of a

Certificate of Dissolution (LLC-3) is not required. (Corp. Code § 17356(a)(3).)

•

The Certificate of Dissolution (LLC-3) may become effective not more than ninety (90) days after filing the

Certificate of Dissolution (LLC-3). If such a future effective date is desired, indicate in a cover letter the

month, day, and year upon which the Certificate of Dissolution (LLC-3) is to become effective.

Complete the Certificate of Dissolution (Form LLC-3) as follows:

Item 1.

Enter the file number issued by the California Secretary of State.

Item 2.

Enter the name of the limited liability company as filed with the California Secretary of State.

Item 3.

The Certificate of Dissolution may contain other information the managers or members filing the

Certificate determine to include. Attach additional pages if necessary.

Item 4.

Enter the number of pages attached, if any. All attachments should be 8 ½” x 11”, one-sided and

legible.

Item 5.

The Certificate of Dissolution (LLC-3) must be executed with an original signature. Facsimiles and

photocopies of the signature are not acceptable for the purpose of filing with the Secretary of State.

If the Certificate of Dissolution (LLC-3) is signed by an attorney-in-fact, the signature must be followed

by the words “Attorney-in-fact for (name of person).”

If the Certificate of Dissolution (LLC-3) is signed by an entity, the person who signs for the entity must

note the exact name, his/her name, and his/her position/title.

If the Certificate of Dissolution (LLC-3) is signed by a trust, the trustee must sign as follows:

______, trustee for _____ trust (including the date of the trust, if applicable).

Example: Mary Todd, trustee of the Lincoln Family Trust (U/T 5-1-94).

Item 6.

Enter the name and address of the person or firm to whom a copy of this filing is to be returned.

•

For further information contact the Business Filings Section at (916) 657-5448.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1