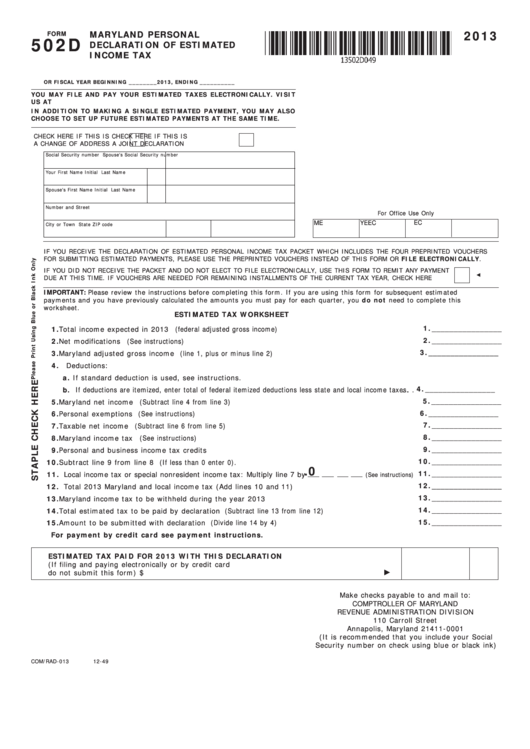

2013

MARYLAND PERSONAL

FORM

502D

DECLARATION OF ESTIMATED

INCOME TAX

OR FISCAL YEAR BEGINNING ________ 2013, ENDING __________

YOU MAY FILE AND PAY YOUR ESTIMATED TAXES ELECTRONICALLY. VISIT

US AT AND LOOK FOR ONLINE SERVICES.

IN ADDITION TO MAKING A SINGLE ESTIMATED PAYMENT, YOU MAY ALSO

CHOOSE TO SET UP FUTURE ESTIMATED PAYMENTS AT THE SAME TIME.

CHECK HERE IF THIS IS

CHECK HERE IF THIS IS

A CHANGE OF ADDRESS

A JOINT DECLARATION

Social Security number

Spouse's Social Security number

Your First Name

Initial Last Name

Spouse's First Name

Initial Last Name

Number and Street

For Office Use Only

ME

YE

EC

EC

City or Town

State

ZIP code

IF YOU RECEIVE THE DECLARATION OF ESTIMATED PERSONAL INCOME TAX PACKET WHICH INCLUDES THE FOUR PREPRINTED VOUCHERS

FOR SUBMITTING ESTIMATED PAYMENTS, PLEASE USE THE PREPRINTED VOUCHERS INSTEAD OF THIS FORM OR FILE ELECTRONICALLY.

IF YOU DID NOT RECEIVE THE PACKET AND DO NOT ELECT TO FILE ELECTRONICALLY, USE THIS FORM TO REMIT ANY PAYMENT

DUE AT THIS TIME. IF VOUCHERS ARE NEEDED FOR REMAINING INSTALLMENTS OF THE CURRENT TAX YEAR, CHECK HERE

IMPORTANT: Please review the instructions before completing this form. If you are using this form for subsequent estimated

payments and you have previously calculated the amounts you must pay for each quarter, you do not need to complete this

worksheet.

ESTIMATED TAX WORKSHEET

1. ________________

1. Total income expected in 2013 (federal adjusted gross income) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. ________________

2. Net modifications (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. ________________

3. Maryland adjusted gross income (line 1, plus or minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Deductions:

a. If standard deduction is used, see instructions.

4. ________________

b. If deductions are itemized, enter total of federal itemized deductions less state and local income taxes. . . .

5. ________________

5. Maryland net income (Subtract line 4 from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. ________________

6. Personal exemptions (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. ________________

7. Taxable net income (Subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. ________________

8. Maryland income tax (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. ________________

9. Personal and business income tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. ________________

10. Subtract line 9 from line 8 (If less than 0 enter 0). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.0

11. ________________

11. Local income tax or special nonresident income tax: Multiply line 7 by

(See instructions)

12. ________________

12. Total 2013 Maryland and local income tax (Add lines 10 and 11) . . . . . . . . . . . . . . . . . . . . . . . . .

13. ________________

13. Maryland income tax to be withheld during the year 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. ________________

14. Total estimated tax to be paid by declaration (Subtract line 13 from line 12) . . . . . . . . . . . . . . . . . . .

15. ________________

15. Amount to be submitted with declaration (Divide line 14 by 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For payment by credit card see payment instructions.

ESTIMATED TAX PAID FOR 2013 WITH THIS DECLARATION

(If filing and paying electronically or by credit card

do not submit this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION

110 Carroll Street

Annapolis, Maryland 21411-0001

(It is recommended that you include your Social

Security number on check using blue or black ink)

COM/RAD-013

12-49

1

1 2

2 3

3